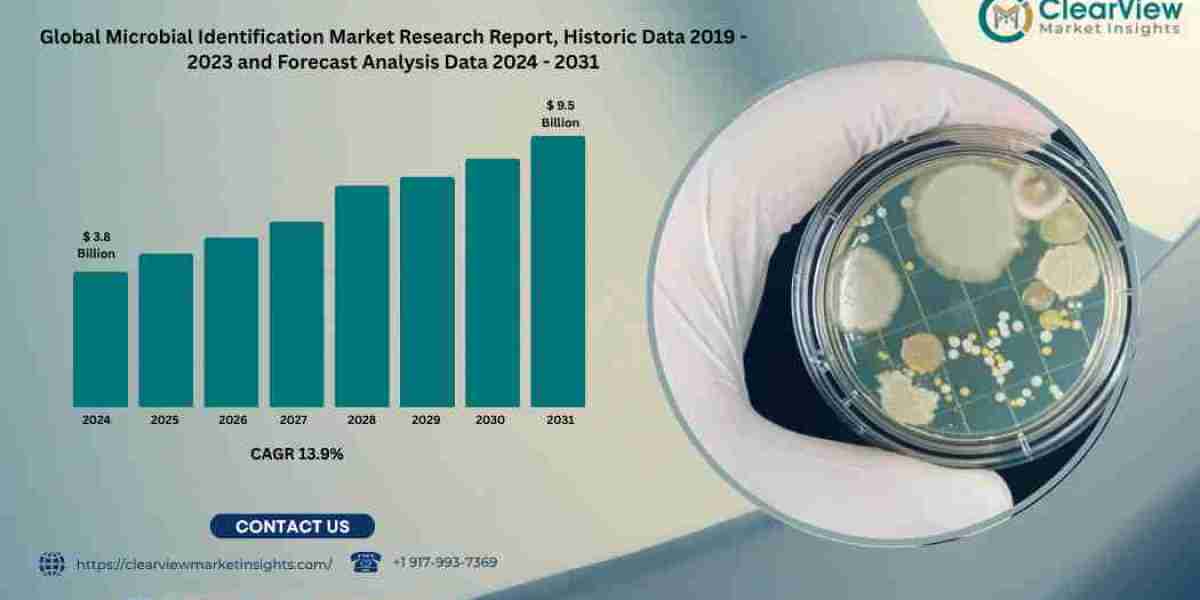

Chicago, 29th May 2025 — Clearview Market Insights (CVMI) projects that the global microbial identification market will expand from USD 3.8 billion in 2024 to USD 9.5 billion by 2031, delivering a robust compound annual growth rate (CAGR) of 13.9 percent. The surge is fueled by escalating antimicrobial‑resistance (AMR) threats, stringent food‑safety mandates, decentralized clinical diagnostics, and digitized sterility‑assurance programs across pharmaceutical manufacturing lines.

“Accurate, rapid organism identification is no longer a bench‑science luxury; it is a frontline defence in public health, drug quality, and brand protection,” said Dr Laura Mitchell, lead diagnostics analyst at CVMI. “Hospitals, biotech firms and food processors are moving beyond colony morphology and classical biochemical panels toward AI‑enhanced MALDI‑TOF, cartridge‑based nucleic‑acid systems, and portable whole‑genome sequencers that cut turnaround times from days to minutes.”

Request Sample @ https://clearviewmarketinsights.com/report-details/global-microbial-identification-market/

Key Numbers

Metric | 2024 | 2031 | CAGR (2024–31) |

Market Value (USD billion) | 3.8 | 9.5 | 13.9 % |

Mass‑Spectrometry Share | 38 % | 34 % | — |

PCR & NAAT Share | XX% | XX% | — |

Sequencing Share | 11 % | 18 % | — |

Clinical Diagnostics Share | XX% | XX% | — |

Pharma & Biotech Share | 28 % | 26 % | — |

Top 5 Vendors’ Combined Share | 60 % | 52 % | — |

Market Drivers

- AMR Surveillance Acceleration – WHO-aligned stewardship programs require tertiary hospitals to report pathogen and resistance profiles within 24 hours, promoting the adoption of cloud-linked ID-AST (identification + antimicrobial-susceptibility testing) systems.

- Pharma Continuous Manufacturing – Real-time microbial monitoring inside modular manufacturing suites reduces batch failure risk, lowering sterility assurance costs by up to 40 percent.

- Food Safety Harmonization – Global Food Safety Initiative (GFSI) audit equivalence and the U.S. Food Safety Modernization Act (FSMA) promote multiplex PCR deployment on protein, dairy, and produce lines to detect Listeria, Salmonella, and pathogenic E. coli.

- Decentralized Testing in Resource-Tight Settings – Battery-powered, cartridge-based devices reach rural clinics and veterinary posts, reducing diagnosis-to-therapy windows during zoonotic outbreaks.

- Environmental & HVAC Biosurveillance – Cleanroom certification and Legionella control regulations drive demand for automated water and air sampling ID platforms.

Company Highlights (2024–Q2 2025)

Company | 2024 Market Share | 2025 Strategic Focus |

bioMérieux | 22 % | Roll‑out of cloud‑native VITEK MS Prime with automated resistance trending and predictive‑analytics dashboards. |

Bruker | 17 % | Launch of MALDI Biotyper® XLMart, adding 1,000+ dermatophyte and anaerobe entries; new R&D hub in Massachusetts. |

Thermo Fisher Scientific | 10 % | Integration of RapidFinder™ multiplex PCR kits with portable Ion Torrent G50 sequencer for field diagnostics. |

QIAGEN | 6 % | Respiratory + fungal syndromic panels on QIAstat‑Dx platform; push into Latin‑American hospital networks. |

Shimadzu | 5 % | Low‑cost MALDI‑8020 platform for food labs in Southeast Asia; alliance with ASEAN public‑health surveillance project. |

Regional Labs & Start‑Ups | 30 % | AI colony‑morphology analytics, disposable microfluidic chips, and contract strain‑library curation services. |

Regional Highlights

- North America – Federal AMR action plans and Medicare reimbursement for rapid ID AST panels support an 8.3% CAGR. Hospital systems consolidate purchasing through enterprise license databases that connect to infection control dashboards.

- Europe – IVDR transition deadlines accelerate platform re-registrations; pharmaceutical CGMP Annex 1 enforcement increases demand for rapid sterility confirmation. Region captures 31% revenue share.

- Asia-Pacific – Fastest growing at 16.4% CAGR. China’s NMPA fast-track epidemic preparedness approvals and India’s CDSCO sterility guidelines spur lab upgrades. Food export hubs in Thailand and Vietnam deploy inline PCR.

- Latin America – Brazil’s meat export compliance with EU Salmonella criteria enhances multiplex assay sales; Mexico strives to certify public labs for AMR genomics.

- Middle East & Africa – Gulf Cooperation Council mandates Legionella monitoring in hotels and health facilities; the African Development Bank funds genomic sequencing hubs for outbreak preparedness.

2024–25 Milestones

Quarter | Event | Outcome |

Q1 2024 | Bruker unveils Biotyper database v13 | Adds 1,000 species; labs report 6 % faster ID run time. |

Q2 2024 | bioMérieux ships 500th VITEK MS Prime | Global user base exceeds 3,000 units; cloud surveillance network activated. |

Q3 2024 | FDA clears QIAstat‑Dx Fungal/Respiratory panel | U.S. hospitals implement combined COVID‑19 + Aspergillus rule‑out algorithm. |

Q4 2024 | Thermo Fisher acquires MicroID Now | Portable NAAT unit gains CLIA‑waived status; rural clinics deploy in flu season. |

Q1 2025 | ASEAN Public Health Network selects Shimadzu MALDI‑8020 | 25 national labs connected to shared pathogen library within six months. |

Technology Trends

- Cloud‑Linked Strain Libraries – Automated harmonization cuts species‑misidentification rates by 70 percent across multi‑site hospital chains.

- AI‑Enabled Colony Morphology – Deep‑learning models read blood‑agar growth patterns in 30 seconds, triaging plates before MALDI confirmation.

- Lab‑on‑a‑Chip PCR – Disposable cartridges deliver <30‑minute pan‑bacterial IDs in veterinary field units.

- Portable Nanopore Sequencing – Real‑time genomic ID during waterborne‑disease outbreaks; enables “sequence where you sample.”

- CRISPR‑Cas13 Diagnostics – Single‑reaction RNA detection achieves femtomolar sensitivity for hard‑to‑culture viruses.

Market Share Table (2024)

Rank | Company | Share | 2025–27 Focus |

1 | bioMérieux | 22 % | Cloud‑integrated ID‑AST, AI resistance prediction |

2 | Bruker | 17 % | Database expansion, MALDI throughput boosts |

3 | Thermo Fisher | 10 % | Portable sequencing, decentralized sterility testing |

4 | QIAGEN | 6 % | Syndromic panels, emerging‑market penetration |

5 | Shimadzu | 5 % | Low‑cost MALDI for food and pharma QC |

6 | Others | 40 % | Niche ID reagents, regional service labs |

Roadmap to 2031

- 2025 – ≥50 % of European reference labs adopt cloud‑connected MALDI‑TOF for real‑time AMR dashboards.

- 2026 – AI‑assisted colony triage halves plate‑reading labour hours in tier‑1 hospitals.

- 2027 – Portable cartridge‑based ID achieves <US$5 per test, unlocking LMIC deployments at scale.

- 2028 – Continuous‑manufacturing pharma lines integrate in‑situ sequencing modules for real‑time sterility verification.

- 2029 – Food‑processing plants phase in 100 % on‑line pathogen ID to meet zero‑recall targets.

- 2030 – Global AMR genomic database surpasses 25 million isolates; predictive models guide formulary updates.

- 2031 – 80 % of urgent‑care clinics worldwide deploy rapid ID‑AST cartridges, cutting inappropriate antibiotic use by 35 percent.

For more insights, visit https://clearviewmarketinsights.com/

About Clearview Market Insights:

Clearview Market Insights is a leading market research and consulting firm providing in-depth industry analysis and strategic recommendations for businesses worldwide.

Media contact:

Bhavani K

Marketing and Sales Head

ClearView Market Insights

Mail: sales@clearviewmarketinsights.com

Phone: +1 917-993-7369