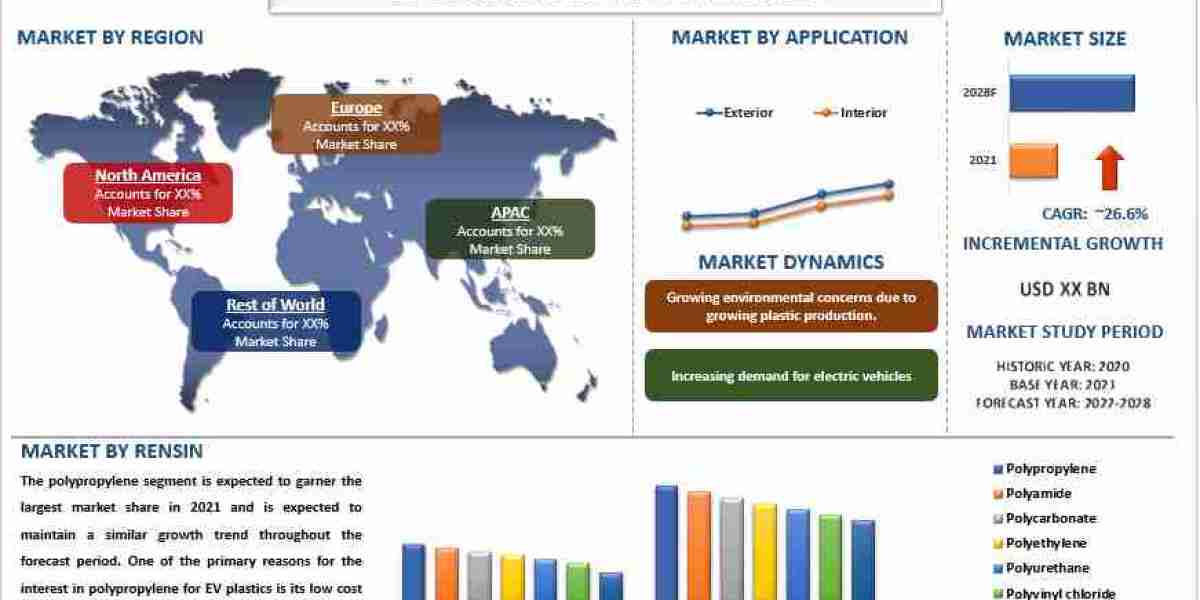

According to a new report published by UnivDatos Markets Insights, the EV Engineering Plastic Market was valued at USD xx million in 2021 & is expected to grow at a CAGR of 26.6% from 2022-2028. The analysis has been segmented into Rensin (Polypropylene, Polyamide, Polycarbonate, Polyethylene, Polyurethane, Polyvinyl Chloride, and Others); Application (Interior and Exterior) Region/Country.

The EV engineering plastic market report has been aggregated by collecting informative data on various dynamics such as market drivers, restraints, and opportunities. This innovative report makes use of several analyses to get a closer outlook on the EV engineering plastic market. The EV engineering plastic market report offers a detailed analysis of the latest industry developments and trending factors in the market that are influencing market growth. Furthermore, this statistical market research repository examines and estimates the EV engineering plastic market at the global and regional levels.

Request for Sample Pages - https://univdatos.com/get-a-free-sample-form-php/?product_id=45583

Key Market Dynamics

Electric vehicles (EVs) are gaining popularity worldwide due to their eco-friendliness and lower operating costs compared to traditional gasoline-powered vehicles. With increasing consumer demand for EVs, the demand for engineering plastics used in the manufacture of these vehicles is also on the rise. Engineering plastics are high-performance polymers that are used to make lightweight and durable components in EVs. These plastics have excellent mechanical, thermal, and electrical properties, making them ideal for use in EVs. Some of the commonly used engineering plastics in EVs include polypropylene (PP), polyurethane (PU), polycarbonate (PC), and acrylonitrile butadiene styrene (ABS).

Furthermore, the EV manufacturing industry is always in need of lightweight materials for EVs. As EVs rely on battery power, reducing weight is crucial for improving their range and overall performance. By using engineering plastics, automakers can reduce the weight of EV components without compromising their strength or durability. This, in turn, improves the energy efficiency and range of EVs, making them more attractive to consumers.

Moreover, another factor driving the growth of the EV engineering plastics market is the need for eco-friendly materials. Engineering plastics are recyclable and have a lower environmental impact compared to traditional materials like metal and glass. This makes them ideal for use in EVs, which are often marketed as environmentally friendly vehicles.

COVID-19 Impact

The impact of COVID-19 on the automotive industry has been significant, as many businesses have been forced to shut down or reduce their operations due to lockdowns and other restrictions. This has led to a decrease in demand for engineering plastics, as many automotive manufacturers have reduced their production levels. However, there are some areas of the automotive industry that have been relatively unaffected by the pandemic, such as the development of electric vehicles (EVs), which has seen an increase in demand for engineering plastics due to the need for lightweight and durable materials.

The global EV Engineering Plastic market report is studied thoroughly with several aspects that would help stakeholders in making their decisions more curated.

- By rensin, the market is polypropylene, polyamide, polycarbonate, polyethylene, polyurethane, polyvinyl chloride, and others. The polypropylene segment held the largest market share in 2021.

- Based on application, the market is segmented into interior and exterior. The exterior segment is expected to have the largest market share of the EV engineering plastic market and is expected to maintain its growth during the forecast period.

EV Engineering Plastic Market Geographical Segmentation Includes:

- North America (U.S., Canada, and the Rest of North America)

- Europe (Germany, UK, Netherlands, France, Norway, Switzerland, Denmark, Rest of Europe)

- Asia-Pacific (China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World

The Asia-Pacific (APAC) region has been experiencing significant growth in the production and adoption of electric vehicles (EVs), which has been driving the demand for EV plastics in the region. Furthermore, one of the key drivers of this growth is government initiatives and policies aimed at reducing greenhouse gas emissions and promoting sustainable transportation. For example, many countries in the APAC region have set targets for the percentage of EVs on their roads by a certain year and offer subsidies or tax incentives to encourage EV adoption.

Related Reports-

Automotive Fan Clutch Market: Current Analysis and Forecast (2023-2030)

Automotive Adaptive Headlight Market: Current Analysis and Forecast (2022-2030

Automotive Actuators Market: Current Analysis and Forecast (2023-2030)

Baggage Handling System Market: Current Analysis and Forecast (2022-2028)

Scroll-E Compressor Market: Current Analysis and Forecast (2023-2030)

EV High Power Charger Market: Current Analysis and Forecast (2022-2030)

Side Shaft Market: Current Analysis and Forecast (2022-2030)

Competitive Landscape

The degree of competition among prominent global companies has been elaborated by analyzing several leading key players operating worldwide. The specialist team of research analysts sheds light on various traits such as global market competition, market share, most recent industry advancements, innovative product launches, partnerships, mergers, or acquisitions by leading companies in the EV Engineering Plastic market. The major players have been analyzed by using research methodologies such as Porter’s Five Forces Analysis for getting insight views on global competition.

Recent Developments:

- In 2020, BASF SE launched Ultradur, a brand of partially crystalline, thermoplastic polybutylene terephthalate (PBT) that offers high strength, stiffness, dimensional stability, and chemical resistance.

- In September 2021, Sabic launched NORYL GTX™ Resin 9500, a non-reinforced alloy of polyphenylene ether (PPE) and polyamide (nylon).

Key questions resolved through this analytical market research report include:

- What are the latest trends, new patterns, and technological advancements in the ev engineering plastic market?

- Which factors are influencing the EV Engineering Plastic market over the forecast period?

- What are the global challenges, threats, and risks in the EV engineering plastic market?

- Which factors are propelling and restraining the EV engineering plastic market?

- What are the demanding global regions of the EV engineering plastic market?

- What will be the global market size in the upcoming years?

- What are the crucial market acquisition strategies and policies applied by global companies?

- What are the descriptive profiles of key companies along with their SWOT analysis?

We understand the requirement of different businesses, regions, and countries, we offer customized reports as per your requirements of business nature and geography. Please let us know If you have any custom needs.

Target Audience:

- Raw material providers

- Service providers

- Market-related associations, organizations, forums, and alliances

- Government bodies, such as regulating authorities and policymakers

- Venture capitalists, private equity firms, and start-up companies

- Distributors and sales firms

- Research institutes, organizations, and consulting companies