Power factor correction (PFC) functions have also become significant because industries and businesses around the globe strive to increase efficiency and lower expenses. As more entities learn the importance of balancing power factors, more companies are exploring modern PFC technologies as well as introducing market solutions that can meet the current power requirement. The power factor correction market has accelerated growth due to increased regulatory and technological initiatives, and the increasing importance of lower energy prices.

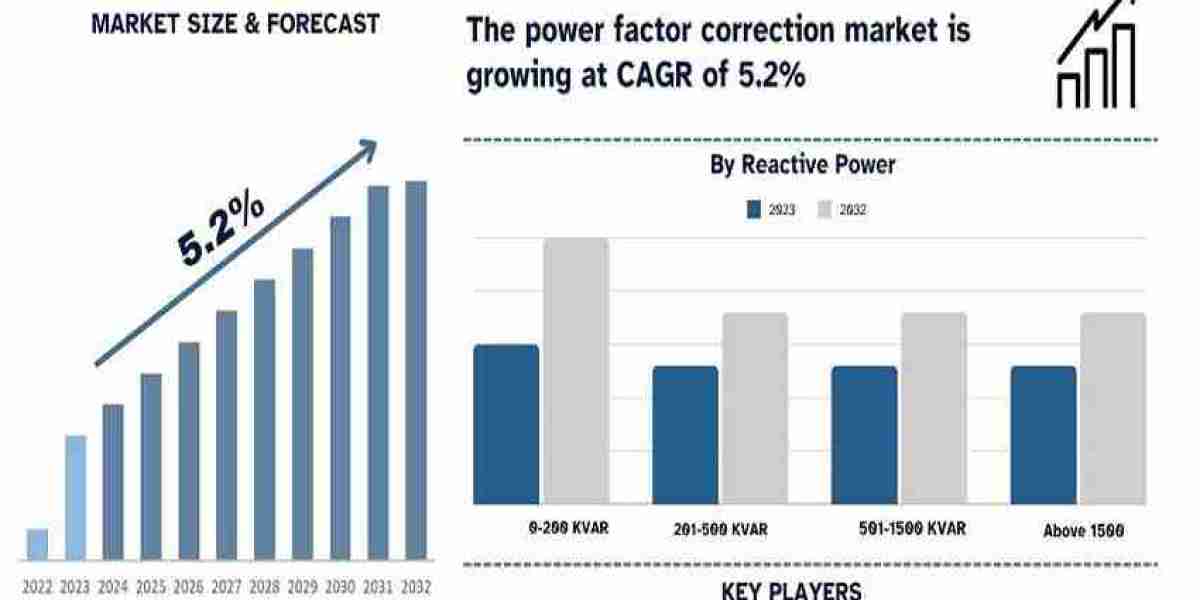

According to the Univdatos Market Insights analysis, the power factor correction market is growing due to rising energy costs, regulatory requirements for efficiency, and the need to reduce power losses. Industries are adopting PFC solutions to lower energy bills and improve equipment lifespan. Additionally, advancements in smart technologies are further boosting demand. As per their “Power Factor Correction Market” report, the global market was valued at USD ~ 2.2 billion in 2023, growing at a CAGR of about 5.2% during the forecast period from 2024 - 2032 to reach USD XX billion by 2032.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=67611

Power factor compensation is an essential aspect of electrical power systems for several reasons as will be seen below.

The basic significance of power factor correction is to increase the efficiency of the electrical systems by limiting the level of reactive power consumption from the supply utility. Improper power factors cause high usage of energy, high demand charges, and possible failure of electrical equipment because of overheating. To overcome these problems, power factor correction technologies have gained popularity in the industries for their long-term advantages which include reduced energy costs, stabilized electrical systems, and increased equipment durability.

As a result of the enhanced regulatory concern in energy efficiency, most governments and utility firms are pressuring companies to embrace PFC technologies. This trend has therefore triggered high investments that aim to foster the creation of new services that answer to the increasing market demands.

Related Industry Reports-

Agrivoltaic Market: Current Analysis and Forecast (2024-2032)

Carbon Offset and Carbon Credit Trading Service Market: Current Analysis and Forecast (2024-2032)

Biopellet Energy Market: Current Analysis and Forecast (2024-2032)

Bifacial Solar Market: Current Analysis and Forecast (2024-2032)

Syngas Market: Current Analysis and Forecast (2024-2032)

New spells of investments and new product launches in the PFC Market

The power factor correction market has had some amount of activity in the last few years, where customers and various market stakeholders have targeted product improvements. Below are some notable examples of recent development in the power factor correction space:

· In July 2024, Hillcrest Energy Technologies (CSE: HEAT) (OTCQB: HLRTF) (FSE: 7HI), a leader in clean technology and power conversion solutions, proudly announces the launch of a testing and demonstration program for its latest Zero Voltage Switching (ZVS) technology application. This initiative showcases a prototype designed to highlight the value of Hillcrest's ZVS technology in power factor correction.

· In 2024, PowerLogic PFC (previously known as VarSet), the low voltage power factor correction solution from Schneider Electric, expands its best-in-class low voltage capacitor bank with robust, IoT-enabled communication capabilities to provide yet another element within the EcoStruxure™ Power architecture. These new proficiencies provide new opportunities for today’s power systems and energy management applications.

· Navitas Semiconductor has announced the Gen-3 ‘Fast’ (G3F) 650V and 1200V SiC MOSFETs optimized for fast switching speed, high efficiency, and increased power density for AI data center power supplies, on-board chargers (OBCs), fast EV roadside super-chargers, and solar / energy-storage systems (ESS). The G3F family is said to offer 40 percent improvement to hard-switching figures-of-merits (FOMs) compared to the competition in critical conduction mode totem-pole power factor correction (CCM TPPFC) systems. This will enable increasing the wattage of next-generation AI power supply units (PSUs) up to 10 kW, and power per rack increase from 30 kW to 100-120 kW.

· In 2024, US-based electronic components manufacturer Power Integrations has agreed to acquire the assets of Odyssey Semiconductor Technologies, a developer of vertical gallium nitride (GaN) transistor technology. The transaction is expected to close in July 2024, after which all key Odyssey employees are expected to join Power Integrations’ organization.

Click here to view the Report Description & TOC- https://univdatos.com/get-a-free-sample-form-php/?product_id=67611

Conclusion:

These new advancements released in the power factor correction market are boosting its growth path. Due to rising concerns associated with energy performance, economic considerations, and legally enforceable rules, the prospects for further development of improved PFC technologies will continue to expand in the next few years. The developments in the market, and the continued technological improvements, are rendering power factor correction as a contender for the future of energy control. With companies remaining committed to improving their product portfolios, the power factor correction market will not only be able to provide businesses with the means of cutting back on costs but also assist with making the world a more environmentally friendly place.

Contact Us:

UnivDatos Market Insights

Contact Number - +1 9782263411

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/