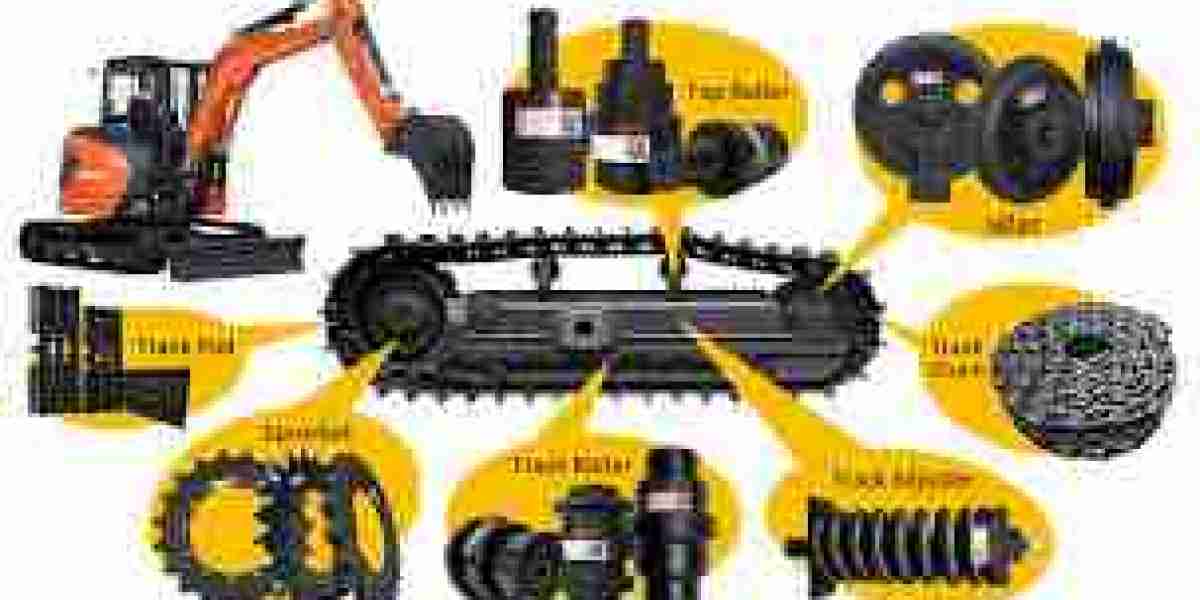

The global undercarriage components market is witnessing robust growth, largely fueled by the rising demand for heavy construction and mining machinery. These components, which include track chains, rollers, idlers, sprockets, and track shoes, are essential for the mobility and functionality of tracked equipment such as excavators, bulldozers, and loaders. The market is benefiting from an upswing in infrastructure development and mining activities across developing and developed economies.

Infrastructure Expansion and Construction Boom Driving Demand

One of the primary drivers of the undercarriage components market is the global push toward infrastructure modernization. Emerging economies in Asia-Pacific, Latin America, and Africa are significantly investing in highways, railways, urban development, and smart cities. Simultaneously, developed regions like North America and Europe are allocating substantial budgets for the repair and upgrade of aging infrastructure.

Large-scale infrastructure projects require reliable and durable construction machinery capable of operating in harsh environments. Undercarriage systems form the backbone of such equipment. As machinery utilization increases, so does the wear and tear on undercarriage components, leading to higher replacement rates and aftermarket demand.

In addition, the growth of public-private partnerships (PPPs) in infrastructure projects has increased the deployment of advanced construction equipment. As a result, OEMs are seeing a surge in orders for new machinery, subsequently boosting the market for original and replacement undercarriage parts.

Mining Industry: A Consistent Revenue Contributor

The mining sector is another critical end-user of undercarriage components. Surface and underground mining operations use heavy-duty tracked vehicles such as hydraulic shovels, mining excavators, and continuous miners. With the global increase in mineral extraction—driven by rising demand for metals like copper, lithium, and rare earth elements—mining operations are scaling up.

This expansion places significant stress on the undercarriage systems of mining equipment, which are frequently exposed to abrasive and challenging terrains. Consequently, there is a high requirement for frequent maintenance and component replacement, fueling the aftermarket demand. The consistent nature of mining operations, often running 24/7, also contributes to higher component turnover and revenue growth in the market.

Rising Emphasis on Equipment Lifespan and Maintenance

Undercarriage components can account for nearly 50% of a machine's total maintenance cost over its lifespan. As such, fleet operators and contractors are increasingly focusing on predictive maintenance and component durability. The adoption of telematics and real-time monitoring systems helps in identifying undercarriage wear, enabling timely replacements and reducing operational downtimes.

OEMs and aftermarket suppliers are leveraging this trend by offering enhanced service packages and condition-based maintenance solutions. Manufacturers are also investing in R&D to develop components with higher wear resistance and longer service intervals. These advancements are not only improving equipment performance but also strengthening brand loyalty and repeat sales.

Technological Advancements and Material Innovation

Material science and manufacturing innovations are playing a pivotal role in shaping the future of undercarriage components. High-strength steel alloys, heat-treated metals, and advanced forging techniques are being used to improve the durability and efficiency of key parts like rollers and track links.

In addition, there is a growing shift toward lightweight yet high-performance materials to enhance fuel efficiency and reduce emissions. Some manufacturers are also experimenting with polymer coatings and ceramic reinforcements to minimize friction and extend component life. These developments are particularly attractive to contractors looking to minimize total cost of ownership (TCO) while maximizing operational uptime.

Aftermarket Expansion and Strategic Distribution

The aftermarket segment of the undercarriage components market is growing rapidly, particularly in regions where equipment utilization rates are high and operating conditions are harsh. Timely replacement of worn-out components is critical for the longevity and efficiency of heavy machinery.

Additionally, digital platforms for component ordering and inventory tracking are making it easier for customers to access spare parts and manage equipment maintenance schedules. The growing digitization of the aftermarket is expected to further streamline supply chains and enhance customer experience.

Regional Insights

Asia-Pacific holds the largest share of the global undercarriage components market, driven by the region’s dominant role in global construction and mining activity. China, India, and Southeast Asian nations are leading in terms of infrastructure spending and mining output.

North America and Europe also represent significant markets, with strong demand for technologically advanced and environmentally compliant machinery. The Middle East and Africa are emerging as promising regions due to oil and gas projects and urbanization trends.

Competitive Landscape and Market Outlook

The undercarriage components market is characterized by a mix of global manufacturers and regional suppliers. Major players such as Caterpillar Inc., Komatsu Ltd., Hitachi Construction Machinery, and Thyssenkrupp are focusing on product innovation, cost optimization, and strategic acquisitions to strengthen their market positions.

Looking ahead, the market is poised for steady growth over the next decade. Factors such as increased investment in public infrastructure, rapid urbanization, and ongoing mining exploration will continue to drive demand. However, challenges like fluctuating raw material prices and supply chain disruptions may impact short-term growth.

Conclusion

The undercarriage components market is experiencing a strong uptrend, backed by surging demand in the construction and mining sectors. As end-users prioritize efficiency, reliability, and maintenance optimization, the market is likely to see continuous innovation and strategic collaborations. Manufacturers that adapt to changing customer needs, invest in durable materials, and expand their service capabilities will be best positioned to capture long-term growth opportunities.