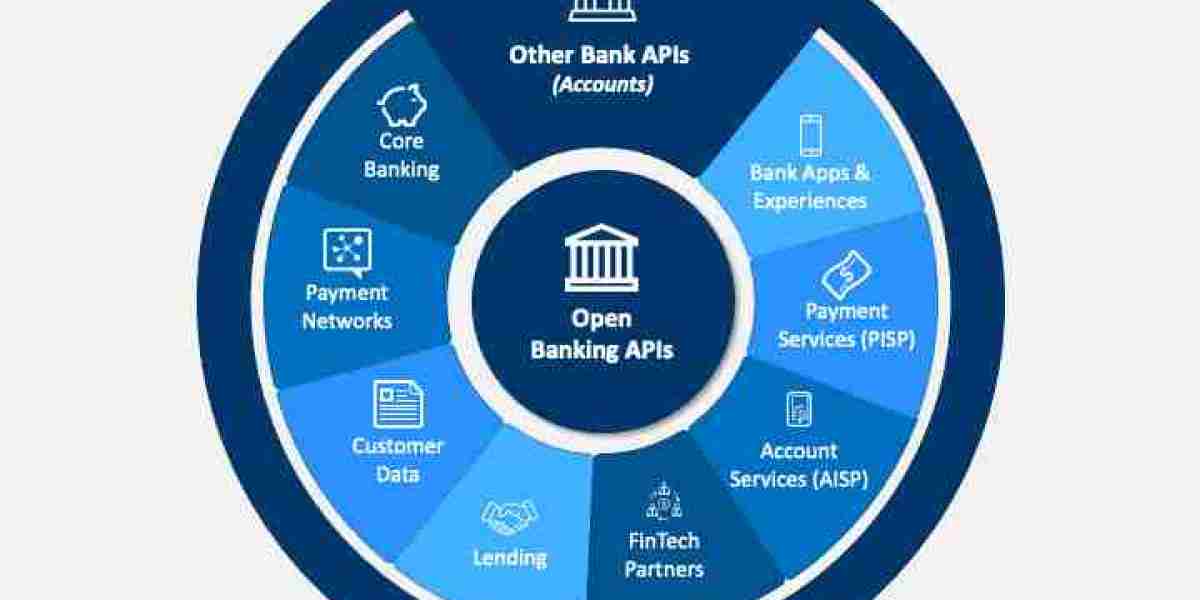

The API banking market has entered a phase of rapid transformation, driven by a global push for digital financial services and growing consumer demand for real-time connectivity. The current market scenario reveals a highly dynamic environment, where banks are rethinking their operating models and forming strategic alliances to deliver agile, customer-centric services. APIs (Application Programming Interfaces) are no longer just tools; they are the foundation upon which the future of banking is being built.

Today, the API banking market scenario reflects a clear shift from closed, monolithic systems to open, collaborative ecosystems. Banks, fintechs, and even non-financial businesses are now working together to provide seamless, digital-first experiences that meet the demands of modern consumers.

Evolving Landscape: From Traditional Banking to Open Ecosystems

Traditionally, banks operated within tightly controlled environments, developing and managing all products and services internally. However, the rise of fintech disruptors, coupled with increasing customer expectations, has challenged this model. In response, banks have adopted APIs to open up their infrastructure, enabling secure connections with third-party applications and platforms.

This shift has created an open banking ecosystem where various players—including startups, payment processors, and tech firms—collaborate to deliver value-added services such as instant loans, digital wallets, budgeting tools, and account aggregation. The API banking scenario is no longer confined to basic functions; it is extending across lending, wealth management, insurance, and business banking.

Current Trends Defining the Market Scenario

Several emerging trends are shaping the present-day API banking market scenario:

Open Banking Regulations: Regulatory frameworks in regions such as the EU, UK, Australia, and India have accelerated the adoption of API-based systems. These mandates encourage banks to share customer data (with consent) with third-party providers, increasing competition and innovation.

Fintech Collaboration: Banks are increasingly forming partnerships with fintech firms rather than competing with them. These collaborations allow banks to enhance their service offerings quickly and efficiently, while fintechs gain access to customer bases and financial infrastructure.

Embedded Finance: Businesses outside the traditional financial sector are embedding banking functionalities within their platforms. Through APIs, companies in retail, travel, and logistics can now offer payment services, financing, and insurance directly to their customers.

Banking-as-a-Service (BaaS): BaaS platforms are enabling non-banks to launch financial services using licensed institutions’ APIs. This trend is broadening access to banking and driving financial inclusion, especially in underbanked markets.

Competitive Dynamics and Market Positioning

The API banking market scenario has redefined competition. It’s no longer just about being the biggest player—agility, developer support, and integration capabilities are now crucial differentiators. Traditional banks are investing heavily in API development, creating developer portals, offering sandbox environments, and encouraging innovation through hackathons and co-creation programs.

Meanwhile, digital-only neobanks and fintech firms are leveraging APIs from the ground up, building lean, modular systems that can evolve rapidly. These players often deliver more personalized, faster, and accessible services than traditional banks, attracting a growing user base.

Large technology companies are also entering the market, offering cloud infrastructure and fintech services that integrate with banking APIs. Their involvement is intensifying competition and pushing incumbents to accelerate their digital strategies.

Regional Scenarios and Market Maturity

The maturity of the API banking market varies significantly by region. In North America and Europe, adoption is advanced due to mature regulatory environments, digital readiness, and robust financial systems. These regions lead in open banking implementations and API innovation.

In Asia-Pacific, particularly India, Singapore, and Australia, digital infrastructure is developing rapidly. Government-led initiatives, fintech ecosystems, and increasing smartphone penetration are driving fast-paced adoption. India’s public digital platforms such as UPI and Aadhaar have demonstrated the transformative power of APIs in financial services.

In Africa and Latin America, the scenario is evolving. Fintech startups are playing a crucial role in expanding financial access, and banks are beginning to adopt APIs to stay competitive. While regulatory clarity is still evolving in these regions, the potential for growth remains strong.

Challenges in the Current Scenario

Despite the promising outlook, the API banking market scenario also presents a number of challenges:

Security Concerns: As banks expose more endpoints to external entities, cybersecurity risks increase. Ensuring secure data transfer, managing access rights, and preventing fraud are critical concerns.

Legacy Infrastructure: Many traditional banks still operate on outdated core banking systems that make API integration difficult and costly.

Lack of Standardization: Different banks and regions use varying API standards, complicating integration for fintech developers and slowing down cross-border collaboration.

Compliance and Privacy: Ensuring compliance with data protection laws, such as GDPR or local equivalents, requires careful handling of customer information shared via APIs.

Future Outlook of the Market Scenario

Looking ahead, the API banking market is expected to expand across sectors, geographies, and use cases. As more industries integrate banking into their digital ecosystems, the role of APIs will continue to grow in importance.

Key opportunities lie in:

Expanding into underserved markets through BaaS models

Developing smarter APIs powered by AI and real-time analytics

Enhancing cross-border payments and financial interoperability through standardized API frameworks

In conclusion, the API banking market scenario is a testament to how technology, regulation, and customer demand are reshaping global finance. From traditional banks modernizing infrastructure to fintechs introducing disruptive solutions, the future of banking is increasingly open, connected, and intelligent.