Semiconductor Chemicals Market Developments

1. Market Overview & Size

The global semiconductor chemicals market is witnessing robust growth. As of 2024, its value is estimated between US $13.9 billion and $15.7 billion, with projections suggesting expansion to approximately $21–30 billion by 2030. Despite slight variations across sources, analysts agree on a clear upward trajectory, with an expected compound annual growth rate (CAGR) of about 12 percent. This points toward a potential tripling of market size within a decade.

2. Key Growth Drivers

Several strong market forces are propelling the semiconductor chemicals segment:

Surging Chip Demand

The exponential rise of artificial intelligence, data centers, 5G networks, Internet of Things (IoT) devices, and automotive electronics is driving unprecedented semiconductor sales.

Electronics Consumption

Increased global usage of smartphones, tablets, wearables, and smart devices is expanding the need for high-purity chemicals used in semiconductor manufacturing processes.

Electric Vehicle Growth

Electric vehicles require advanced semiconductor components for battery systems, autonomous driving, and digital interfaces. This has resulted in a notable uptick in demand for ultra-pure etchants, cleaning solutions, and deposition chemicals.

Advanced Chip Processes

The transition to 3nm and 5nm nodes, alongside extreme ultraviolet (EUV) lithography, demands newer chemical formulations with extremely high purity levels.

Governmental Incentives and On-shoring

Policies such as the U.S. CHIPS and Science Act and the European Union’s Chips Act are incentivizing regional semiconductor production, thereby boosting localized demand for semiconductor-grade chemicals.

3. Segment Analysis

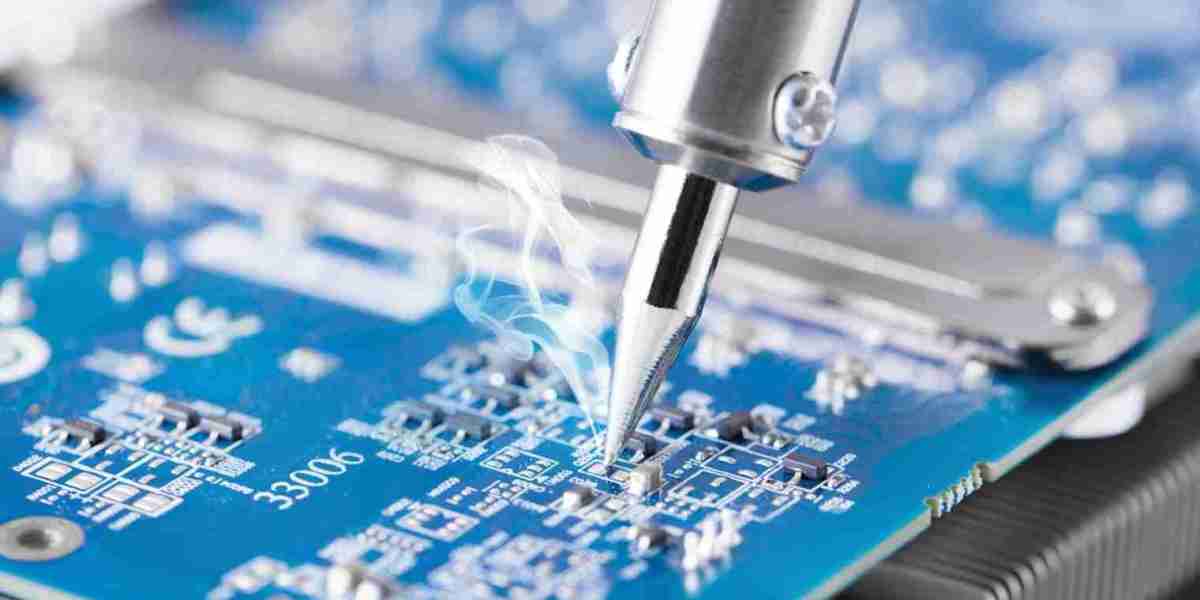

Type of Chemicals

Acid and Base Chemicals

Hydrofluoric, sulfuric, and nitric acids, along with potassium hydroxide and other bases, form the core of semiconductor cleaning and etching operations. These comprise roughly 40 to 45 percent of the market share.

Solvents and Polymers

Solvents like isopropyl alcohol and high-performance polymers such as fluoropolymers and polyimides are gaining traction, especially in packaging and encapsulation.

Adhesives

UV-curable, silicone-based, and epoxy adhesives are increasingly being used in assembly and advanced packaging techniques, though currently holding a smaller market share.

Application Areas

Cleaning and etching processes consume the largest share of chemicals, followed by those used in lithography (photoresists) and deposition. Integrated circuits represent the primary end-use, followed by discrete devices, sensors, and photonic components.

4. Regional Insights

Asia-Pacific

This region dominates the global market, contributing 35 to 44 percent of the total value. Countries like China, Taiwan, South Korea, and Japan are home to the majority of fabrication facilities and chemical producers.

North America

The U.S. market is expanding due to new fabrication plants supported by federal subsidies. The region is also investing heavily in localizing the production of specialty chemicals.

Europe

European nations are focusing on sustainable semiconductor manufacturing and developing less emissions-intensive chemicals. Countries like Germany and France are emphasizing the production of mature nodes with a greener profile.

5. Technology and Environmental Considerations

Innovation in Materials

EUV lithography and chiplet-based architecture are accelerating the need for higher-purity photoresists, developers, and new deposition materials. The emergence of compound semiconductors such as gallium nitride (GaN) and silicon carbide (SiC) for power electronics is also boosting specialized chemical requirements.

Environmental Impact

The industry’s use of per- and polyfluoroalkyl substances (PFAS), commonly referred to as “forever chemicals,” is under regulatory scrutiny. Governments across North America and Europe are tightening regulations due to PFAS’s persistence and potential health effects. Companies are now investing in eco-friendly alternatives and recycling solutions.

Supply Chain and Geopolitics

Ongoing export restrictions by the U.S. on advanced semiconductor technologies and chemicals have reshaped supply chains, particularly affecting Chinese manufacturers. In response, domestic firms in China are focusing on achieving self-sufficiency in chemical production. Similar strategic vertical integrations are underway in other regions to enhance resilience.

6. Competitive Landscape

The semiconductor chemicals market is moderately consolidated, with leading players including SK Inc., BASF SE, Dow Inc., Merck KGaA, Honeywell International, Sumitomo Chemical, Fujifilm, Solvay, DuPont, JSR Corporation, and Wacker Chemie.

These companies are focusing on product innovation, strategic partnerships, and capacity expansions. For example, Wacker Chemie anticipates a 10 percent rise in demand for its semiconductor-grade polysilicon and silicones by 2025.

Meanwhile, emerging players in Asia are rapidly scaling up operations. Companies like Zhuhai Cornerstone Technologies are developing domestic photoresist capabilities to reduce reliance on imports and compete with Japanese leaders such as Shin-Etsu and JSR.

7. Outlook and Strategy

The global semiconductor chemicals market is on a strong growth path driven by megatrends in technology, automotive, and industrial digitalization. The following strategic actions are critical:

Invest in Sustainable Chemistry: Develop low-emission, PFAS-free alternatives to address environmental and regulatory concerns.

Strengthen Supply Chains: Increase resilience through vertical integration and local partnerships.

Align with Fab Expansion: Leverage the $1 trillion-plus investments in new fabrication facilities by aligning with their chemical needs.

Focus on Advanced Nodes and Materials: Stay ahead of demand by supplying chemicals that meet the precision requirements of 3nm and beyond.

Adapt to Geopolitical Changes: Monitor and respond to policy shifts, export restrictions, and regional manufacturing incentives.

Conclusion

The semiconductor chemicals market is poised for significant expansion, driven by technological innovations, fab investments, and geopolitical shifts. Market participants must strategically align their capabilities with emerging chip technologies and sustainability goals to stay competitive. High-purity, reliable, and environmentally compliant chemicals will be key enablers of next-generation semiconductor manufacturing.