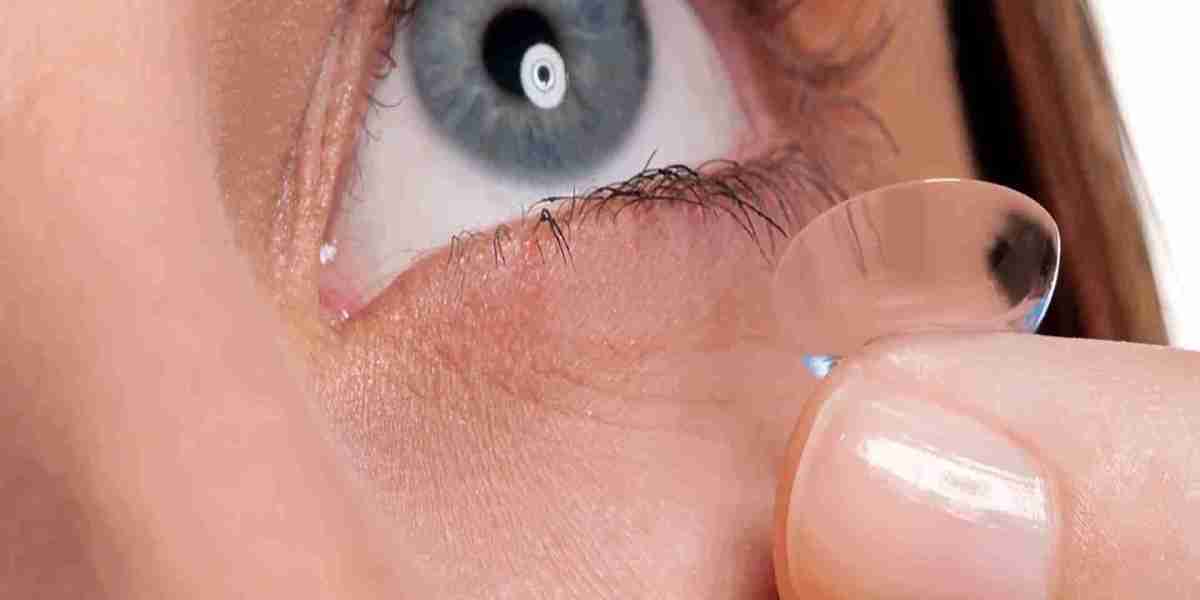

The disposable contact lenses market is one of the fastest-growing segments within the broader vision care and medical device industry. With increasing global demand for corrective and cosmetic lenses, rising eye health awareness, and technological innovations, this sector has captured the attention of investors, venture capital firms, and private equity players.

As the market becomes more dynamic and competitive, understanding the investment landscape and recent funding trends is critical for stakeholders—whether they are startups, established players, or investors seeking to capitalize on healthcare innovation.

Market Overview: A Lucrative Investment Frontier

The global disposable contact lenses market was valued at over USD 10 billion in 2024 and is expected to grow at a CAGR of around 5–6% through 2030. Key growth drivers include:

Increasing global prevalence of myopia and astigmatism.

Rising preference for daily disposable lenses due to hygiene concerns.

Expanding middle-class populations in emerging economies.

Growth of online optical retail platforms and tele-optometry.

Advancements in lens materials and drug-delivery functionalities.

These trends have sparked heightened interest among healthcare investors, especially those focused on vision care, digital health, and sustainable materials.

Key Investment Areas in the Disposable Contact Lenses Market

1. Product Innovation and R&D

Investors are backing companies that focus on next-generation lens technologies, such as:

Drug-eluting contact lenses for chronic eye conditions like glaucoma.

Smart lenses with biosensors for real-time monitoring.

Biodegradable or eco-friendly lenses to address sustainability concerns.

Startups and R&D-focused firms developing such products are frequently targets of early-stage venture capital and strategic corporate investments.

2. Direct-to-Consumer (DTC) Startups

The rise of subscription-based contact lens startups has revolutionized how lenses are marketed and sold. Brands like Hubble, Waldo, and Sightbox have received millions in funding for offering affordable, convenient, and digitally integrated services.

These companies appeal to investors due to:

Scalable business models.

Strong unit economics.

High customer lifetime value.

Many also operate with vertical integration, controlling both manufacturing and distribution, which improves margins and consumer loyalty.

3. E-commerce and Digital Platforms

Companies building AI-powered vision testing platforms, online prescription renewals, and virtual try-on tools have attracted significant capital in recent years. Investors see potential in combining telemedicine with product sales, creating an end-to-end digital eye care solution.

Recent Funding Highlights

Hubble Contacts raised over $70 million from firms like FirstMark Capital and Greycroft to expand its subscription service globally.

Waldo secured $13 million in Series A funding to grow its presence in the U.S. and U.K. markets with a DTC focus.

SightGlass Vision, a company developing lenses to slow myopia progression, received strategic funding from CooperVision and EssilorLuxottica.

InnoVision Labs, focused on digital eye exams and smart lenses, attracted seed funding from healthcare-focused angels and institutional backers.

These investments reflect a broader trend of convergence between medtech, e-commerce, and consumer wellness.

Role of Strategic Partnerships and M&A

In addition to direct investments, mergers and acquisitions (M&A) are shaping the competitive landscape. Large vision care companies are acquiring innovative startups to strengthen their technology portfolios and consumer outreach.

Notable M&A Examples:

CooperVision's acquisition of Paragon Vision Sciences expanded its specialty lens capabilities.

Alcon’s purchase of PowerVision, a lens technology startup, shows the appetite for tech-driven product pipelines.

Strategic partnerships are also common, with large players funding smaller firms in exchange for exclusive distribution rights or co-development agreements.

Funding Challenges and Investment Risks

Despite the opportunity-rich environment, investors face several challenges:

Regulatory hurdles: New products must pass stringent FDA or EU MDR approvals.

High R&D costs: Developing novel lenses or smart technology is capital-intensive with long timelines.

Market saturation: Established giants dominate the space, leaving limited room for commoditized offerings.

Customer retention: Subscription services must balance acquisition cost with churn management.

For investors, performing due diligence on clinical efficacy, regulatory pathways, and intellectual property is crucial.

Emerging Opportunities in Developing Markets

Asia-Pacific, Latin America, and parts of Africa represent untapped growth potential. Rising urbanization, increased screen time, and growing middle-class populations are driving demand for affordable and accessible vision care.

Investment Opportunities:

Affordable DTC brands tailored for price-sensitive consumers.

Local manufacturing hubs to reduce import dependency.

Strategic alliances with local optometrists and clinics.

Investors targeting these regions can benefit from first-mover advantage, especially by funding startups that understand local regulatory and consumer landscapes.

Conclusion

The disposable contact lenses market is not only a segment of clinical eye care but also an emerging arena for innovation-driven investment. With the convergence of healthcare, technology, and consumer services, opportunities abound for investors to support businesses shaping the future of vision correction.

As product offerings evolve and digital channels expand, funding will increasingly flow toward companies that can deliver efficacy, accessibility, and affordability. Investors with a strategic, long-term approach will be best positioned to benefit from the next wave of growth in this fast-moving industry.