The battery electrode coating market plays a vital role in the performance, life cycle, and efficiency of lithium-ion and other advanced batteries. However, as the global demand for energy storage systems surges—fueled by electric vehicles (EVs), consumer electronics, and renewable energy grids—so do the complexities and challenges facing this specialized market segment.

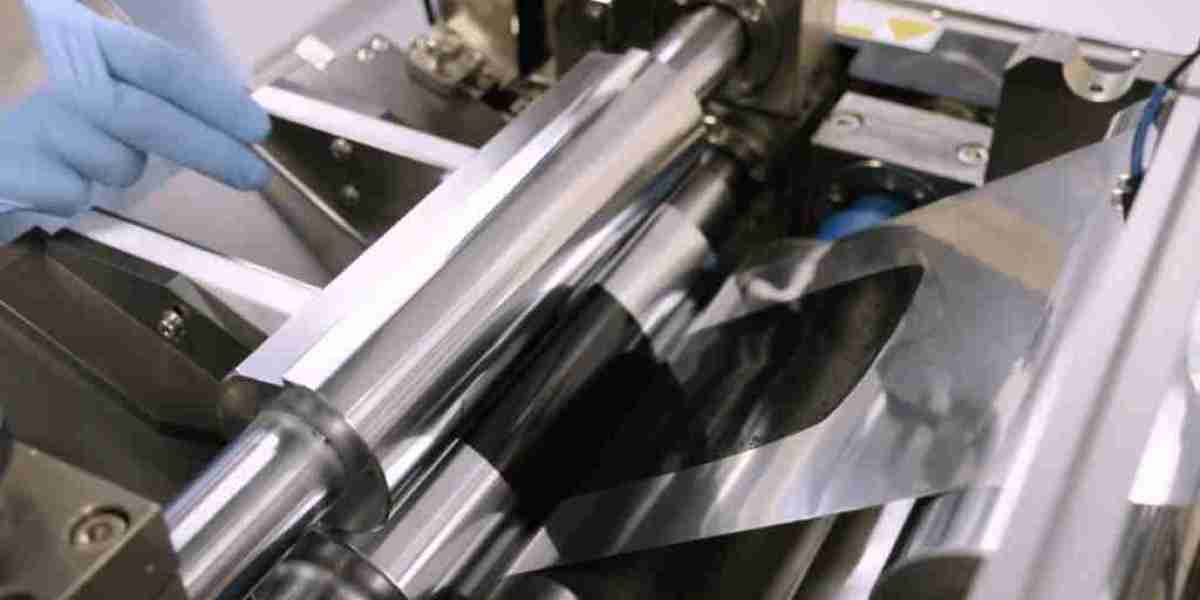

One of the most pressing challenges is scaling up production while maintaining consistent coating quality. Battery manufacturers are under pressure to meet growing global demand, yet the electrode coating process remains highly sensitive. Uniformity in coating thickness, adherence, and drying is essential to ensure battery safety and performance. Even minor inconsistencies can lead to reduced energy density or thermal runaway risks. The precision required makes it difficult to implement at large scales without significant investment in advanced coating and quality control technologies.

Raw material availability and costs pose another significant hurdle. Electrode coatings often rely on rare or refined materials such as lithium, nickel, cobalt, and graphite. Fluctuating commodity prices and geopolitical tensions in key supplying regions such as the Democratic Republic of Congo or South America create supply chain volatility. In response, companies are investigating alternative materials and recycling solutions, but these efforts are still in development stages and far from achieving cost-effective scalability.

Moreover, the market struggles with environmental and regulatory constraints. Traditional electrode coating methods often involve solvents like N-Methyl-2-pyrrolidone (NMP), which are hazardous to both health and the environment. Regulatory bodies, especially in Europe and North America, are increasingly restricting or banning such chemicals. The shift toward water-based and dry electrode coating methods is promising but comes with its own technical challenges, including achieving sufficient conductivity and drying speeds without sacrificing quality.

Technological compatibility and integration issues also hamper progress. Battery designs are evolving rapidly, with new chemistries like solid-state batteries, lithium-sulfur, and sodium-ion gaining attention. Each of these technologies may require different coating techniques, making current equipment and processes obsolete or less effective. Manufacturers must continually invest in R&D to adapt to these changes, increasing capital expenditure and technical risk.

A further complication is the lack of standardization across the industry. There is no universal benchmark for coating thickness, material composition, or process validation, leading to variations in quality and performance between suppliers. This inconsistency impacts downstream applications, especially in sectors like EVs where safety and reliability are paramount. Collaborative efforts between governments, industry bodies, and manufacturers to establish common standards are underway but are yet to be broadly adopted.

Additionally, high capital and operational costs deter new entrants and small-scale innovators. Advanced coating lines require expensive machinery, cleanroom environments, and skilled operators. The long payback period discourages investment, especially in uncertain market conditions or during early-stage development. This limits competition and slows innovation in the field.

Intellectual property (IP) challenges further compound these issues. Proprietary processes and formulations dominate the electrode coating space, creating barriers to entry and complicating licensing or technology transfer. Innovators face legal risks if they inadvertently infringe on existing patents, while smaller firms may struggle to protect their own innovations against well-funded competitors.

Lastly, sustainability concerns and consumer expectations are evolving rapidly. Stakeholders increasingly demand transparency about material sourcing, carbon footprints, and end-of-life recyclability. Meeting these expectations while also maintaining competitive pricing and high performance requires significant changes in supply chain design, product development, and marketing.

Despite these formidable challenges, the battery electrode coating market holds immense potential. Breakthroughs in dry coating technology, automation, AI-driven quality inspection, and green chemistry could revolutionize the sector in the coming decade. However, realizing these advancements will require coordinated action across the supply chain, increased public and private investment, and a long-term commitment to innovation and sustainability.