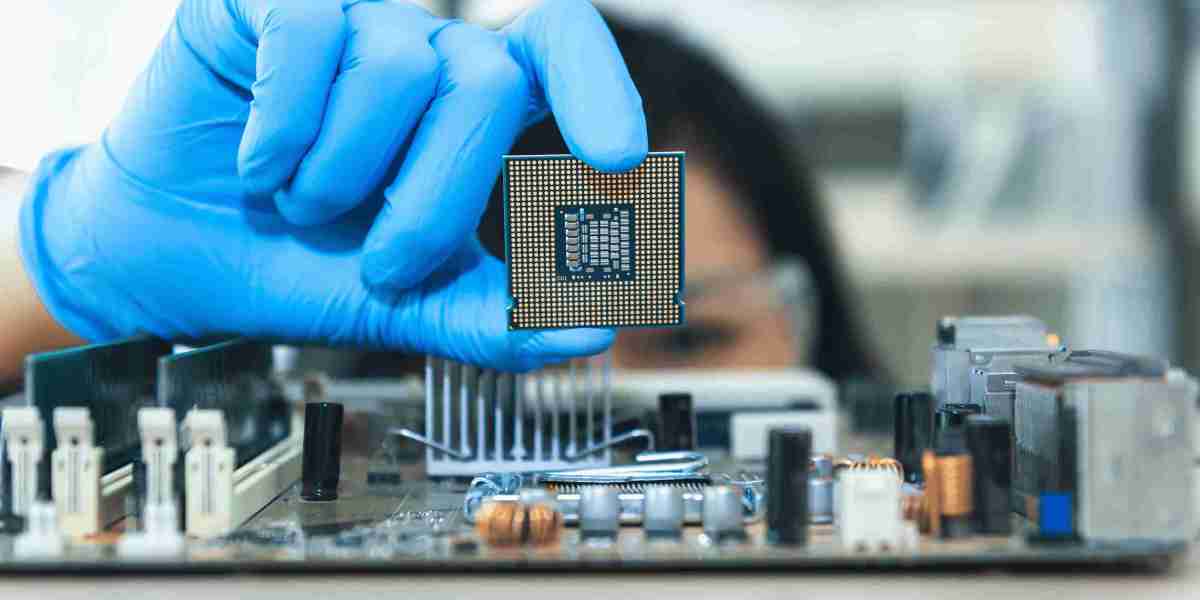

The Semiconductor Assembly and Testing Services (SATS) market plays a pivotal role in the semiconductor supply chain, particularly in ensuring that chips are correctly packaged, tested, and ready for commercial use across various industries. As the semiconductor industry continues to experience rapid growth and increasing complexity, the SATS market is evolving to meet the demand for advanced technologies and more reliable, efficient, and cost-effective solutions. In this article, we examine the current scenario of the SATS market, considering key trends, challenges, and growth drivers shaping the landscape today and in the near future.

Growing Complexity and Demand for Advanced Packaging

The most defining trend in the SATS market today is the increasing complexity of semiconductor devices. Semiconductor chips are no longer simple components; they are integral to almost every modern technological application. From smartphones and computers to automobiles and medical devices, semiconductors are becoming more powerful and highly integrated, leading to more complex assembly and testing requirements.

Advanced packaging technologies such as 3D packaging, System-in-Package (SiP), chiplet integration, and Fan-Out Wafer-Level Packaging (FOWLP) have emerged as critical solutions to manage these challenges. These techniques enable the integration of multiple dies into a single package, enhancing performance and miniaturization. As semiconductor designers push for smaller and more powerful devices, SATS providers are expected to invest in cutting-edge packaging technologies to meet these demands.

This shift toward more intricate packaging solutions is pushing SATS providers to adopt more sophisticated testing methods. Traditional methods are no longer sufficient to ensure the performance and reliability of these complex packages. As a result, testing now involves a combination of thermal, electrical, and mechanical stress testing, requiring high precision and automation to maintain throughput without sacrificing quality.

Rising Demand Across Key Sectors

Another major factor driving the SATS market is the rising demand for semiconductors across a wide array of industries. The proliferation of 5G networks, the development of autonomous vehicles, the growth of artificial intelligence (AI), and the transition to electric vehicles (EVs) are just a few of the sectors heavily reliant on semiconductors, all of which have specific needs for assembly and testing.

For instance, the automotive sector is becoming increasingly reliant on high-performance chips for various systems, such as advanced driver-assistance systems (ADAS), infotainment, and battery management systems in electric vehicles. These chips often require robust packaging and rigorous testing to meet the industry’s high safety and reliability standards.

Similarly, 5G infrastructure requires a steady supply of semiconductors capable of handling high-frequency, high-speed communication. SATS providers are increasingly called upon to meet these specifications, often working with telecom giants to ensure their components meet stringent performance requirements.

The AI and machine learning sectors also present opportunities for SATS providers. AI chips are complex and require packaging solutions that can handle vast data throughput and power dissipation. In response, SATS companies are focusing on providing highly reliable and efficient testing services to meet these high-performance requirements.

Supply Chain Challenges and Regional Realignment

Despite its positive growth trajectory, the SATS market is not without challenges. The semiconductor supply chain has been under considerable strain in recent years, with disruptions caused by the COVID-19 pandemic, geopolitical tensions, and trade wars. Many countries have recognized the vulnerabilities of being overly dependent on a handful of Asian nations for critical semiconductor services.

As a result, countries like the United States, European Union, and India are now focusing on reshoring or diversifying semiconductor production. This regional realignment is influencing the SATS market, as localizing or diversifying assembly and testing facilities will require considerable investment in infrastructure, skilled labor, and technology.

In particular, the U.S. CHIPS Act, which incentivizes domestic semiconductor manufacturing, is expected to spur growth in the local SATS market. Similarly, in Europe, governments are pushing for the establishment of semiconductor hubs to reduce reliance on Asian manufacturers. These geopolitical and supply chain shifts will create new opportunities but also pose challenges for existing SATS providers, who will need to adapt to different regulatory environments and workforce requirements.

Competitive Landscape

The SATS market remains highly competitive, with several major players dominating the global landscape. Companies such as ASE Technology, Amkor Technology, JCET Group, and Powertech Technology hold significant market share, offering a wide range of packaging and testing services. However, there are growing opportunities for smaller, specialized players in regions like India, Eastern Europe, and Latin America, where local demand is increasing.

Competitive pressure is particularly intense in terms of technological innovation. Companies are investing heavily in new packaging and testing solutions, automation, and artificial intelligence to improve operational efficiency, reduce costs, and enhance service offerings. Firms that can provide faster turnaround times, cost-effective solutions, and cutting-edge technology are expected to lead the market in the coming years.

Conclusion

The Semiconductor Assembly and Testing Services (SATS) market is witnessing rapid growth driven by the increasing complexity of semiconductor devices and rising demand from key sectors such as automotive, telecommunications, and AI. As the market continues to evolve, SATS providers are expected to focus on advanced packaging, automated testing, and regional diversification to stay competitive.