Crypto Wallet Market Opportunities: A Growing Ecosystem

The global cryptocurrency ecosystem has evolved rapidly over the last decade, with digital currencies like Bitcoin, Ethereum, and many others attracting millions of investors, traders, and institutions. With this surge in interest, the need for secure, user-friendly, and reliable crypto wallets has significantly increased. As digital assets become more mainstream, the crypto wallet market has emerged as a pivotal player in the broader crypto landscape. In this article, we will explore the opportunities that lie within the crypto wallet market, focusing on its growth prospects, trends, and factors driving its expansion.

The Rise of Cryptocurrency and the Need for Crypto Wallets

A cryptocurrency wallet is a software application that enables users to send, receive, and store their digital currencies. It is a fundamental tool for interacting with blockchain networks, ensuring that users can securely access and manage their assets. Crypto wallets come in various forms, including software wallets (mobile or desktop applications), hardware wallets (physical devices), and even paper wallets (written or printed keys).

As cryptocurrencies have gained widespread adoption, the demand for crypto wallets has surged. According to reports, the number of active cryptocurrency users worldwide has grown exponentially, with millions of people relying on wallets to manage their holdings. This growth can be attributed to several factors, including increased interest from institutional investors, rising consumer awareness, and the growing acceptance of cryptocurrencies as a legitimate form of payment.

Opportunities in the Crypto Wallet Market

Expanding User Base and Market Penetration

As cryptocurrencies continue to gain popularity, the crypto wallet market is set to benefit from an expanding user base. The increasing adoption of digital currencies in emerging markets and the growing use of cryptocurrencies for remittances, online payments, and investment purposes present significant growth opportunities for wallet providers. Furthermore, as governments and regulatory bodies begin to embrace cryptocurrency, the broader acceptance of these digital assets is expected to drive further wallet adoption.

Market penetration in countries with lower financial inclusion presents a significant opportunity for crypto wallets. In regions where traditional banking infrastructure is lacking, cryptocurrency offers an alternative means of financial participation, and crypto wallets are the gateway to accessing these opportunities. For instance, many Africans have turned to cryptocurrency as a store of value and for cross-border transactions, driven by the limitations of traditional banking systems.

Increased Focus on Security and Privacy

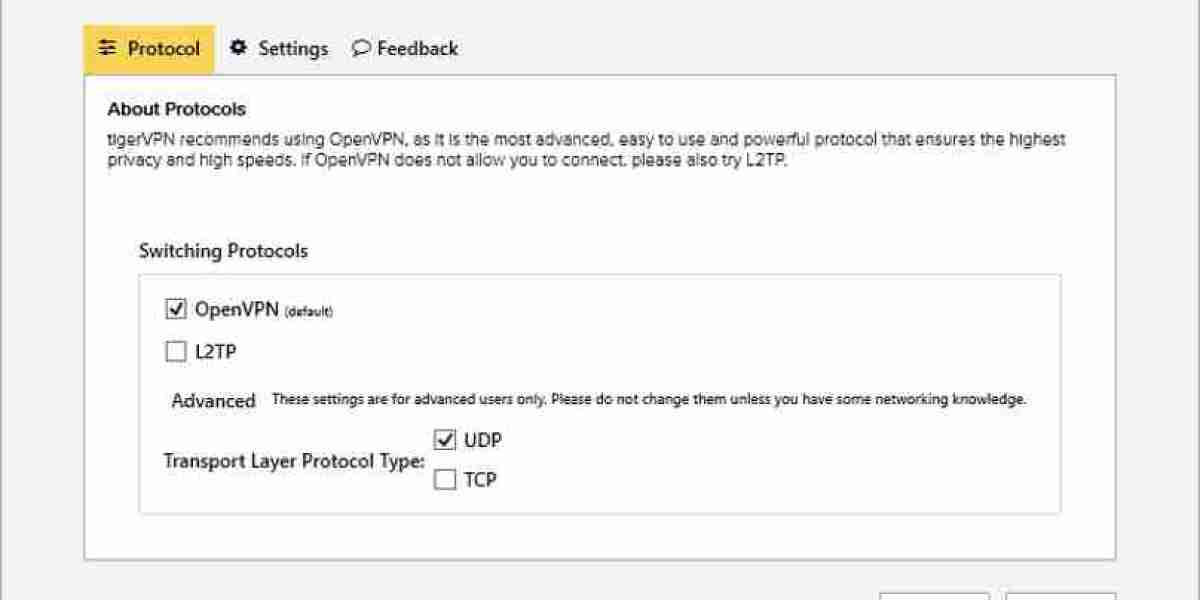

Security remains one of the top concerns for crypto wallet users, as the decentralized nature of cryptocurrencies makes them susceptible to hacking and fraud. The increasing frequency of cyber-attacks on crypto exchanges, wallet services, and individual users has raised concerns about the safety of digital assets. As a result, the demand for wallets with advanced security features, such as multi-factor authentication, biometric verification, and cold storage options, is growing.

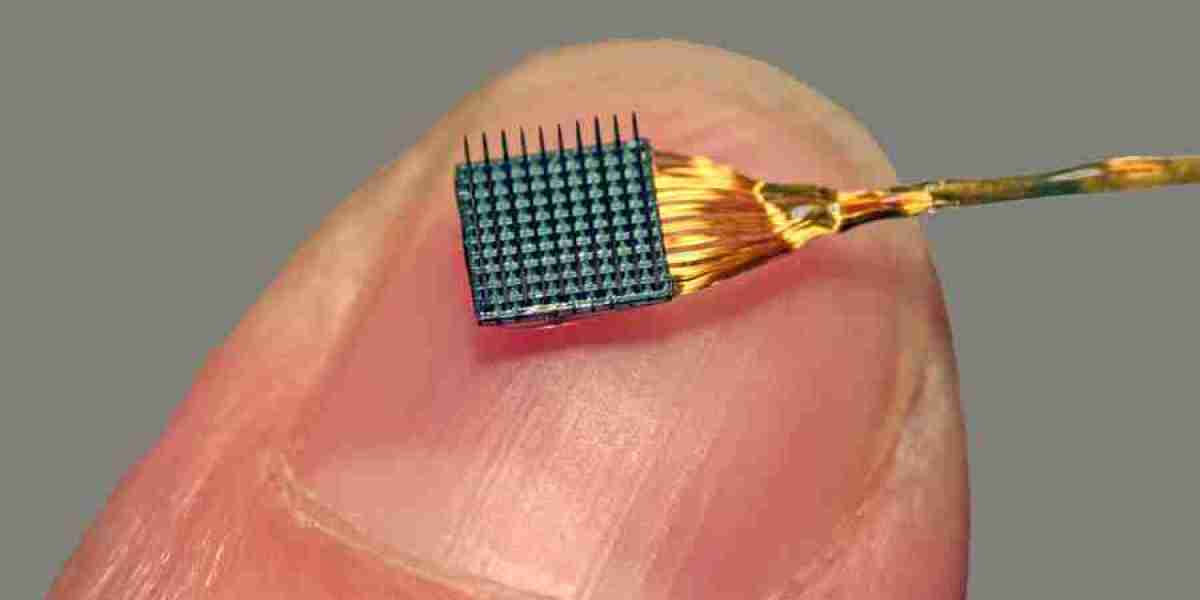

Crypto wallet companies that prioritize robust security protocols have a significant opportunity to capture market share. Hardware wallets, which store private keys offline, are gaining popularity for their added security compared to software wallets. As threats to digital asset security continue to evolve, wallet providers have a chance to innovate by offering enhanced security features and services that instill greater confidence in users.

Integration with Decentralized Finance (DeFi)

The decentralized finance (DeFi) space has emerged as one of the most transformative trends in the cryptocurrency industry. DeFi platforms offer users the ability to access financial services such as lending, borrowing, trading, and yield farming without intermediaries like banks. Crypto wallets that integrate seamlessly with DeFi protocols have a unique opportunity to cater to the growing demand for decentralized financial services.

Wallets that offer integrated DeFi features allow users to interact directly with decentralized applications (dApps), facilitating activities like staking, lending, and earning passive income. As DeFi continues to grow, wallets that provide easy access to these platforms will become increasingly valuable. The ability to connect to DeFi protocols with a single wallet could drive user acquisition and enhance the wallet's utility, making it a one-stop-shop for managing digital assets and participating in decentralized finance.

Cross-Platform and Multi-Currency Support

Another opportunity in the crypto wallet market is the demand for wallets that support multiple cryptocurrencies and blockchain networks. As the number of digital assets continues to rise, users are looking for wallets that can handle various coins and tokens in one place. Multi-currency wallets enable users to store a wide range of digital assets, from Bitcoin and Ethereum to lesser-known altcoins and stablecoins.

Cross-platform functionality is also critical, as users want to access their wallets seamlessly across different devices, whether on their smartphones, desktops, or hardware wallets. Wallet providers that offer easy synchronization across multiple platforms, combined with multi-currency support, will be well-positioned to cater to the diverse needs of users.

Regulatory and Institutional Adoption

The regulatory environment surrounding cryptocurrency is evolving, with many countries starting to implement frameworks for digital asset regulation. This trend presents a unique opportunity for crypto wallet providers to align their services with the legal requirements of different jurisdictions. Compliance with regulatory standards, such as anti-money laundering (AML) and know your customer (KYC) protocols, can help wallet providers attract institutional investors and enhance trust among users.

Institutional adoption is another driving force behind the growth of the crypto wallet market. As large financial institutions, hedge funds, and asset managers increasingly allocate funds to cryptocurrencies, they require secure and compliant wallet solutions to manage their assets. Crypto wallets that can meet the needs of institutional clients by offering features like multi-signature access, custody solutions, and enterprise-grade security will be in high demand.

User Experience and Simplified Onboarding

While security and functionality are critical, the user experience (UX) of crypto wallets remains a major factor in their success. The complexity of blockchain technology can be intimidating to new users, which creates an opportunity for wallet providers to simplify onboarding processes. User-friendly interfaces, educational resources, and intuitive designs can help users navigate the often-complicated world of cryptocurrency with ease.

Wallet providers that offer a smooth and straightforward experience, especially for beginners, will have an edge in attracting new users. Additionally, integration with fiat-to-crypto exchanges and simplified processes for buying and selling cryptocurrencies can help bridge the gap between traditional finance and the crypto world, making it easier for people to get started.

Conclusion

The crypto wallet market presents a wealth of opportunities driven by the growing adoption of cryptocurrencies, the rise of decentralized finance, and increasing security concerns. As the market continues to evolve, wallet providers that prioritize security, user experience, and integration with emerging technologies will be well-positioned to capitalize on these opportunities. The future of the crypto wallet market looks bright, with significant growth potential across a variety of sectors, from individual users to institutional players. As cryptocurrencies become more mainstream, crypto wallets will play a crucial role in enabling secure, seamless, and user-friendly access to the digital economy.