While the atrial fibrillation (Afib) market is experiencing significant growth, there are several key restraints that could hinder its full potential. These limitations primarily revolve around issues related to the accessibility and affordability of treatments, the complexity of diagnosis, and regulatory challenges.

One major restraint is the high cost of advanced treatments and technologies. Although new diagnostic tools, such as wearable devices and portable ECG monitors, are increasingly available, they may not be affordable for all patients. This creates a disparity in access to early diagnosis, particularly in low-income regions or among underinsured populations. Additionally, while minimally invasive procedures like catheter ablation have shown promising results, these treatments can be expensive, limiting their availability to a smaller segment of the population.

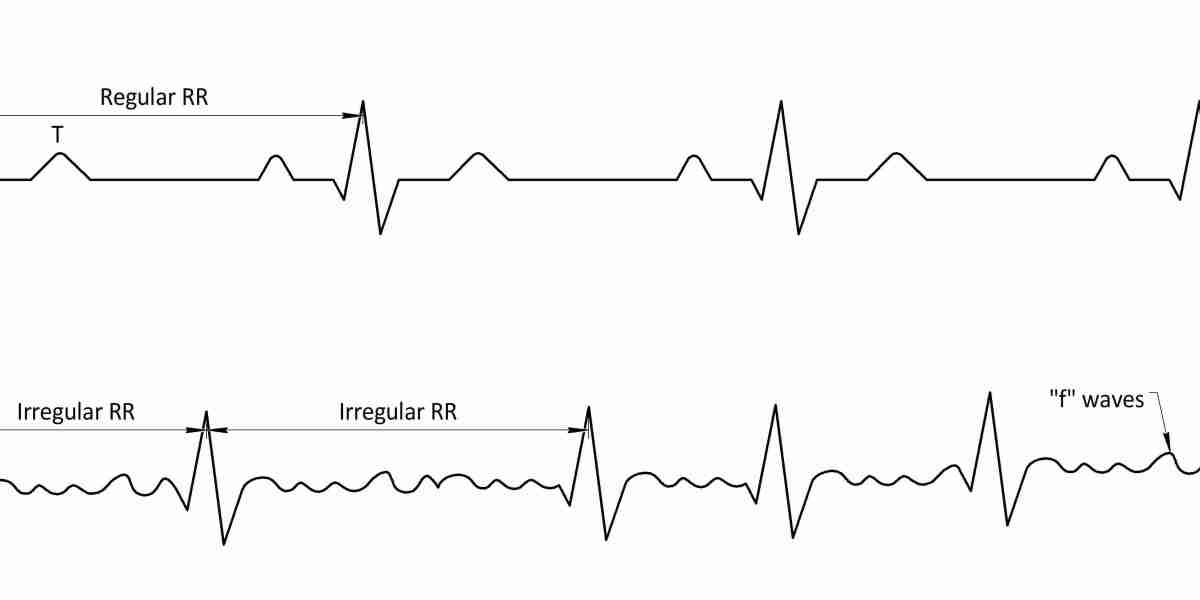

Another challenge in the Afib market is the complexity of diagnosing the condition. Despite technological advancements, diagnosing Afib can still be difficult, particularly in patients with intermittent or asymptomatic arrhythmias. Many individuals may not exhibit noticeable symptoms until the condition progresses, which complicates early detection. The reliance on specialized equipment for accurate diagnosis, combined with the need for trained professionals, may further contribute to delays in identifying Afib.

Regulatory hurdles also pose a significant restraint on the Afib market. The approval process for new treatments, drugs, and medical devices can be lengthy and costly, delaying the availability of new therapies. Strict regulatory requirements and lengthy clinical trials may slow down the pace at which innovations reach the market, limiting the ability of healthcare providers to offer the most up-to-date treatments.

In summary, while the Afib market holds considerable promise, the challenges related to cost, diagnostic complexity, and regulatory issues must be addressed to unlock its full potential and ensure broader access to effective care.