The global seafood market is characterized by its dynamic nature, with fluctuations influenced by environmental, economic, political, and consumer-driven factors. Within this landscape, the wild pollock market one of the most significant sectors in the whitefish industry has experienced its own share of volatility. Despite being anchored by strong production and sustainability credentials, wild pollock is not immune to market uncertainties.

Volatility in the wild pollock market arises from a combination of natural resource variability, shifting trade dynamics, regulatory changes, and evolving consumer behavior. This blog provides an in-depth overview of the causes of wild pollock market volatility, its effects on the value chain, and how the industry is responding to ensure stability and resilience.

The Foundation of the Wild Pollock Market

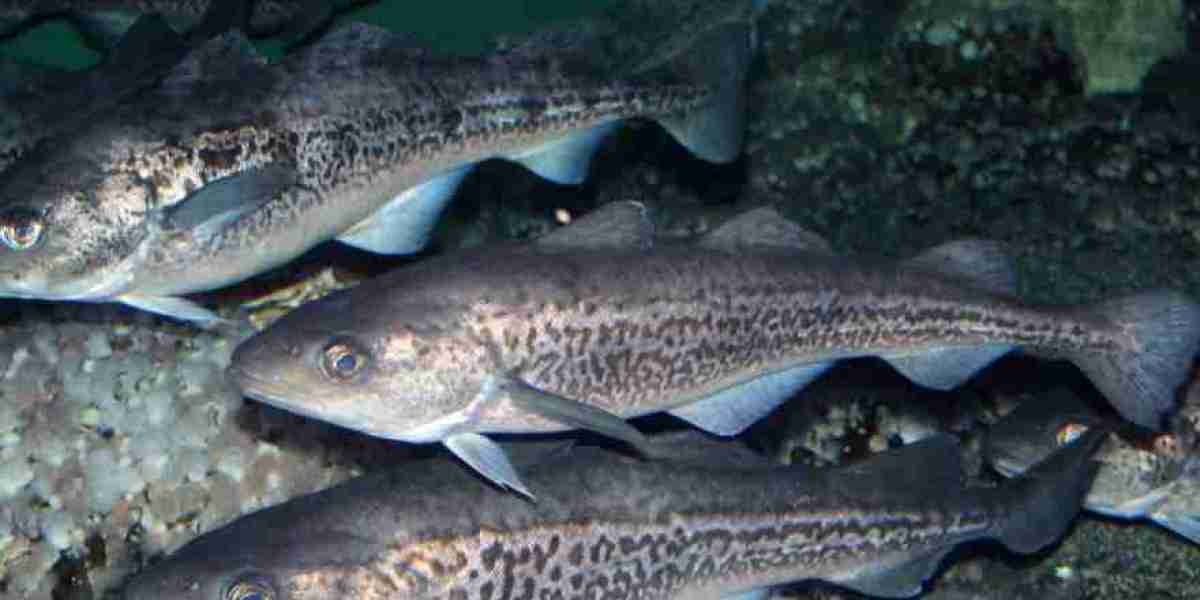

Wild pollock, primarily sourced from the North Pacific Ocean, particularly the Bering Sea and Sea of Okhotsk, is one of the most widely harvested and consumed whitefish species in the world. It is a critical resource for processed seafood products such as surimi (used in imitation crab), fish sticks, frozen fillets, and prepared meals.

The United States (notably Alaska) and Russia are the two dominant players in wild pollock production. These regions have well-managed fisheries that support substantial annual harvests, often exceeding several million metric tons. Despite this strong foundation, several factors contribute to market volatility.

Key Drivers of Wild Pollock Market Volatility

1. Environmental and Climatic Factors

One of the most unpredictable forces impacting the wild pollock market is environmental variability. Changes in ocean temperature, salinity, and currents often linked to broader climate change patterns affect pollock migration, spawning behavior, and biomass distribution

For example, unusually warm waters in the Bering Sea can lead to reduced recruitment of juvenile pollock, impacting future stock levels. Variability in fish availability leads to fluctuating quotas, which in turn affects supply levels and pricing across global markets.

2. Geopolitical Tensions and Trade Restrictions

Geopolitical developments, including sanctions, tariffs, and international trade disputes, significantly affect wild pollock trade. In recent years, strained relations between Russia and Western nations have led to shifts in trade patterns, including export bans and import restrictions.

These geopolitical shifts force exporters to redirect shipments, alter contracts, and seek new markets, which can create short-term oversupply or undersupply conditions. Trade disruptions also introduce logistical complexities and cost variations that ripple across the industry.

3. Global Supply Chain Disruptions

The COVID-19 pandemic highlighted vulnerabilities in global supply chains, and the seafood industry was no exception. Processing plant closures, labor shortages, container shortages, and shipping delays impacted the timely delivery of wild pollock products to key markets.

While the industry has recovered to some extent, residual impacts on freight costs and logistics capacity continue to contribute to periodic volatility, particularly during peak seasons or when market demand surges unexpectedly.

4. Consumer Demand Fluctuations

Consumer preferences are not static. Health trends, economic conditions, and cultural shifts influence demand for seafood products. For instance, increased interest in plant-based diets or premium seafood options can reduce demand for traditional processed pollock formats.

Conversely, during economic downturns, budget-conscious consumers may increase demand for affordable proteins like wild pollock. These changes can cause price swings and impact production planning, especially for value-added product lines.

Impact Across the Supply Chain

Market volatility affects every level of the wild pollock supply chain from harvesters and processors to exporters, distributors, and retailers. For harvesters, unpredictable quotas or environmental changes can lead to lost income or equipment underutilization. Processors must navigate pricing uncertainty and adjust production capacity to align with fluctuating demand.

Exporters face challenges in securing stable trade routes, while retailers and foodservice operators may encounter inconsistent product availability or pricing, making menu planning and inventory control more complex.

Strategies for Mitigating Volatility

Despite these challenges, the wild pollock industry has developed several adaptive strategies to mitigate volatility:

Diversified Market Access: Producers and exporters are expanding their customer base beyond traditional markets to reduce dependence on any single region.

Flexible Processing Operations: Investments in adaptable production lines allow processors to shift between product types based on market signals.

Sustainability and Certification: Maintaining credible sustainability certifications builds buyer trust and ensures long-term resource stability, helping to counter environmental uncertainty.

Data-Driven Forecasting: Advanced analytics and satellite data are being used to monitor fish populations and environmental conditions, aiding in proactive quota management and harvest planning.

Cold Chain Investments: Enhanced cold storage and transportation infrastructure help buffer supply disruptions and extend product shelf life.

Conclusion

Volatility is an inherent feature of the wild pollock market, shaped by environmental shifts, geopolitical events, and evolving global demand. While these fluctuations pose challenges, the industry’s strong foundation in sustainability, its adaptive capacity, and its global reach provide a buffer against long-term instability.

By continuing to invest in innovation, market diversification, and responsible resource management, stakeholders across the wild pollock value chain can not only navigate volatility but also unlock new opportunities for growth in a changing global seafood landscape.