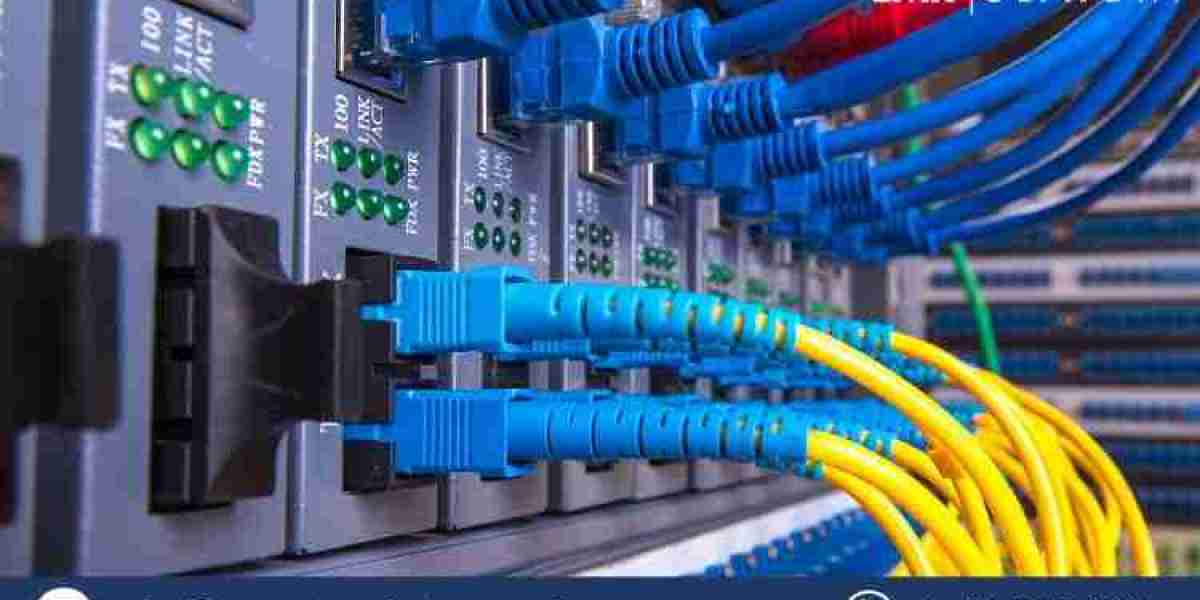

The global structured cabling market size has gained significant traction, reaching an estimated value of USD 12.30 billion in 2024. With the rising demand for high-speed data transmission, robust network infrastructure, and increasing cloud adoption, the market is poised for steady expansion. Analysts project a compound annual growth rate (CAGR) of 8.4% from 2025 to 2034, with the industry expected to reach USD 26.00 billion by 2034.

Structured cabling solutions support a wide range of industries, including telecommunications, data centers, industrial automation, and smart buildings. This article explores the market's key drivers, challenges, trends, and segmentation while providing a data-driven perspective on future growth opportunities.

Market Overview and Growth Drivers

Several factors contribute to the rising demand for structured cabling systems. These include:

1. Growing Demand for High-Speed Data Transmission

The rapid increase in data consumption, driven by 5G technology, cloud computing, and IoT applications, has created a strong demand for high-performance network infrastructure. Structured cabling systems ensure seamless connectivity, reduced latency, and enhanced data transfer speeds, making them essential for modern businesses.

2. Expansion of Data Centers

As companies rely more on cloud services, hyperscale and colocation data centers are expanding worldwide. Efficient cabling solutions enable better power management, scalability, and network optimization in data centers. Leading players such as Equinix and Digital Realty continue investing in high-speed fiber-optic cabling to meet evolving network demands.

3. Smart Buildings and IoT Integration

The structured cabling industry benefits from the rising adoption of smart buildings and IoT devices. Advanced cabling infrastructure enables seamless integration of automation systems, security cameras, HVAC control, and intelligent lighting, creating energy-efficient and digitally connected environments.

4. Digital Transformation in Enterprises

Enterprises are investing in digital transformation to enhance productivity and operational efficiency. Structured cabling provides a future-ready communication backbone, ensuring optimal network performance in corporate offices, manufacturing plants, and healthcare facilities.

5. Government Initiatives and Infrastructure Development

Governments worldwide are investing in digital infrastructure to improve broadband access, promote Industry 4.0, and accelerate 5G deployment. This push increases the demand for structured cabling, particularly in developing economies where telecom expansion is a priority.

Market Challenges

Despite its promising growth, the structured cabling market faces several challenges:

1. High Initial Investment Costs

Deploying structured cabling solutions requires significant upfront investment, particularly in large-scale projects such as data centers and industrial facilities. Some businesses hesitate to invest due to budget constraints.

2. Complexity in System Upgrades

Many organizations operate on legacy network systems, making the transition to modern structured cabling a complex and time-consuming process. Businesses must ensure compatibility with existing infrastructure while upgrading their networks.

3. Shortage of Skilled Professionals

The market faces a shortage of skilled technicians and network engineers capable of designing and installing structured cabling systems. Without adequate expertise, businesses may experience installation delays and performance issues.

4. Cybersecurity Concerns

As data transmission speeds increase, cybersecurity threats pose a significant challenge. Companies must invest in secure cabling systems and advanced encryption technologies to prevent unauthorized access and data breaches.

Key Market Trends (2025-2034)

Several emerging trends will shape the structured cabling market over the next decade:

1. Increasing Adoption of Fiber Optic Cabling

Fiber optic cables offer higher bandwidth, lower latency, and greater transmission speeds than traditional copper cables. As businesses demand ultra-fast connectivity, fiber optic solutions will see widespread adoption in 5G networks, AI applications, and cloud computing.

2. Growth in Power over Ethernet (PoE) Technology

PoE technology allows electrical power and data transmission over a single Ethernet cable, reducing installation costs and simplifying network expansion. This trend will drive demand for PoE-compatible structured cabling systems in smart buildings, surveillance systems, and industrial automation.

3. Modular and Scalable Cabling Solutions

Companies seek flexible, modular cabling systems that can adapt to evolving technology needs. Scalable solutions support future network expansions without requiring significant infrastructure changes, reducing long-term costs.

4. Rise of Edge Computing

With edge computing becoming a critical component of IT infrastructure, businesses require structured cabling solutions that support distributed computing environments. Localized data processing reduces latency and improves real-time analytics, boosting demand for high-speed fiber connectivity.

5. Sustainability and Green Cabling Solutions

Eco-friendly cabling solutions made from recyclable and low-carbon materials are gaining traction. Organizations prioritize energy-efficient data centers and green network infrastructure, fueling demand for sustainable structured cabling systems.

Market Segmentation

1. By Component

- Cables (Copper & Fiber Optic)

- Connectivity Solutions (Patch Panels, Connectors, Jacks)

- Cable Management (Racks, Cabinets, Trays)

- Services (Installation, Maintenance, Consulting)

Cables form the largest segment, with fiber optic cabling experiencing the highest growth rate due to its superior speed and reliability.

2. By Cable Type

- Copper Cables (Cat 5E, Cat 6, Cat 6A, Cat 7, Cat 8)

- Fiber Optic Cables (Single Mode & Multi-Mode)

Category 6A and 7 copper cables remain widely used, while fiber optic solutions witness rising adoption in high-performance applications.

3. By Application

- Data Centers

- Enterprise Networks

- Industrial Automation

- Residential & Commercial Buildings

- IT & Telecommunications

Data centers account for the largest share, with rapid cloud expansion driving structured cabling demand.

4. By Region

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Latin America

North America leads the market, driven by data center investments and early adoption of 5G technology. Meanwhile, Asia-Pacific is the fastest-growing region, fueled by government initiatives, industrial automation, and digital transformation.

Competitive Landscape and Key Players

Several major companies dominate the structured cabling industry, including:

- CommScope – A leader in fiber optic and network infrastructure solutions.

- Corning Inc. – Specializes in optical fiber and connectivity solutions.

- Legrand – Provides structured cabling solutions for data centers and enterprises.

- Panduit Corp. – Known for innovative structured cabling and PoE technologies.

- Belden Inc. – Offers a wide range of high-performance network cabling systems.

- Schneider Electric – Focuses on sustainable and energy-efficient cabling solutions.

These companies continuously innovate and expand their product portfolios to meet the growing demand for structured cabling.

Future Outlook (2025-2034)

The structured cabling market is set for steady expansion, with key growth drivers including:

- Increased investments in data centers and cloud computing

- Rapid adoption of 5G and IoT technologies

- Rising demand for high-speed fiber optic networks

- Government initiatives for digital infrastructure development

- Advancements in PoE and green cabling solutions

By 2034, the market will double in size, driven by the need for reliable, high-speed connectivity across industries.