Managing money effectively is one of the most crucial life skills, yet many people struggle with personal finance. Whether it's budgeting, saving, investing, or planning for retirement, small, consistent financial decisions can make a significant impact over time. The key to long-term wealth isn't about earning a huge salary—it's about making smart choices with the money you have.

In today's digital age, staying informed about financial trends and strategies is easier than ever. Websites like Timesnib and Kannada News Today provide valuable updates on banking, investment trends, and financial planning to help you stay ahead.

Why Personal Finance Matters

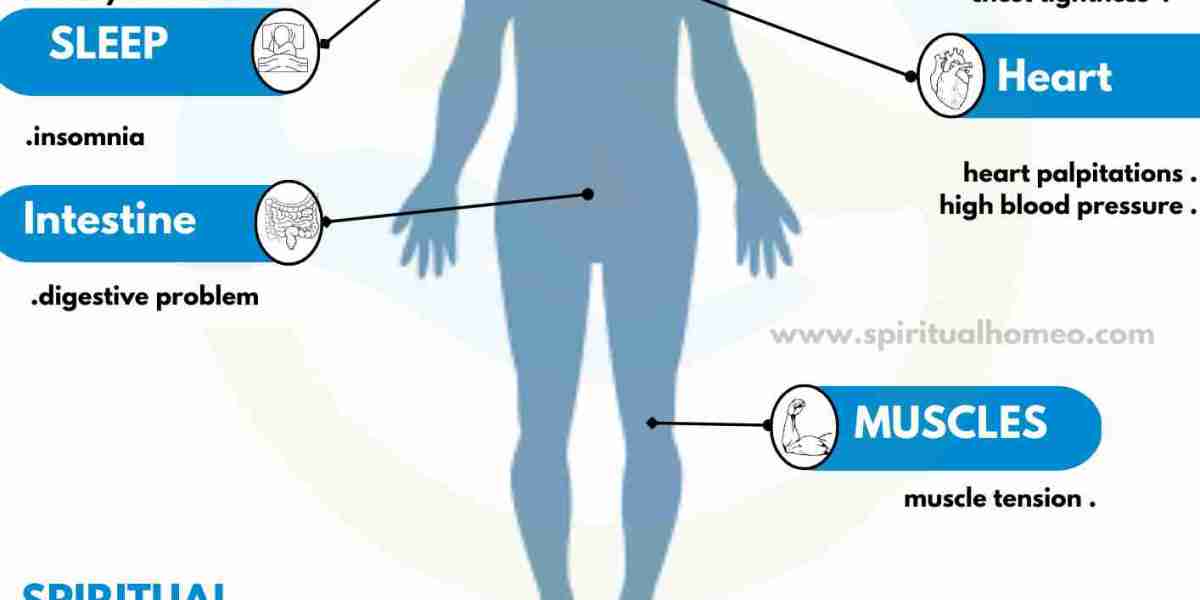

Financial stability isn't just about having enough money to pay bills; it's about creating a secure future where you can handle unexpected expenses, enjoy a comfortable lifestyle, and retire without financial stress. Proper financial planning can:

- Reduce financial stress and anxiety

- Help you achieve major life goals like buying a home or traveling

- Provide security during emergencies

- Enable early retirement or financial independence

Understanding personal finance and making small, smart financial choices can lead to a more secure and prosperous future.

Essential Personal Finance Strategies

1. Budgeting: The Foundation of Financial Success

Creating and following a budget is the first step toward financial stability. It helps you track your income and expenses, ensuring that you spend within your means. A simple budgeting strategy is the 50/30/20 rule:

- 50% of your income for necessities (rent, bills, groceries)

- 30% for discretionary spending (entertainment, shopping, dining out)

- 20% for savings and investments

Using budgeting apps or financial tracking tools can make this process even easier.

2. Emergency Fund: Your Financial Safety Net

Unexpected expenses—like medical bills, car repairs, or sudden job loss—can derail financial plans. Having an emergency fund with at least 3-6 months’ worth of expenses ensures you’re prepared for financial surprises. Keep this money in a high-yield savings account for easy access and steady growth.

3. Smart Saving and Investing

Simply saving money isn’t enough; you must invest it wisely to beat inflation and grow your wealth. Here are a few investment options:

- Fixed Deposits & Recurring Deposits – Low-risk options for stable returns

- Stock Market & Mutual Funds – Higher returns over time but require knowledge and patience

- Gold & Real Estate – Traditional long-term investments with potential appreciation

- Retirement Plans (EPF, PPF, NPS) – Secure your future by contributing regularly

For the latest financial market updates, you can visit Timesnib and stay informed about smart investment strategies.

4. Avoiding Debt Traps

Debt can be a major hurdle in achieving financial stability. While loans and credit cards are helpful, mismanaging them can lead to financial stress. Here’s how to manage debt effectively:

- Pay off high-interest debt first (like credit cards)

- Avoid taking unnecessary loans for luxury purchases

- Use the Debt Snowball or Avalanche method to clear debts systematically

- Maintain a good credit score by paying EMIs and credit card bills on time

5. Retirement Planning: Start Early, Retire Comfortably

The earlier you start saving for retirement, the easier it will be. Take advantage of tax-saving retirement plans like PPF (Public Provident Fund), NPS (National Pension System), or EPF (Employees' Provident Fund). Even small monthly contributions can grow into a substantial corpus due to compound interest.

6. Side Income: Multiple Streams for Financial Freedom

In today’s world, relying solely on one source of income can be risky. Explore additional income streams like:

- Freelancing (writing, graphic design, consulting)

- Investing in dividend stocks

- Starting a small business or online store

- Renting out property or assets

Diversifying income sources ensures financial stability and helps you achieve financial independence faster.

How Financial Awareness Helps You Make Better Decisions

Many people make poor financial choices simply because they lack awareness. Staying informed about financial news, banking updates, and government policies can help you make better money decisions. Websites like Kannada News Today provide the latest financial news in Kannada, keeping you updated on changes in taxation, investment trends, and economic policies.

Final Thoughts: Take Control of Your Financial Future

Achieving financial success isn't about luck; it’s about making small, consistent efforts every day. Start by budgeting, saving, investing wisely, and avoiding unnecessary debt. Over time, these small actions will compound, leading to financial security and independence.

For regular updates on finance, banking, and investment news, visit Timesnib and Kannada News Today. Stay informed, make smarter financial choices, and secure your future today!