The Dimethylolpropionic Acid (DMPA) Market is increasingly gaining traction as rising investments in waterborne coating solutions reshape the global chemicals and coatings industry.

Waterborne Coatings Surge as Industry Shifts Toward Sustainability

Environmental awareness and stringent global regulations are fueling the transition away from solvent-based coatings. Waterborne coatings, which offer lower volatile organic compound (VOC) emissions and safer handling, have become a strategic focus for industries ranging from automotive and construction to consumer packaging and electronics.

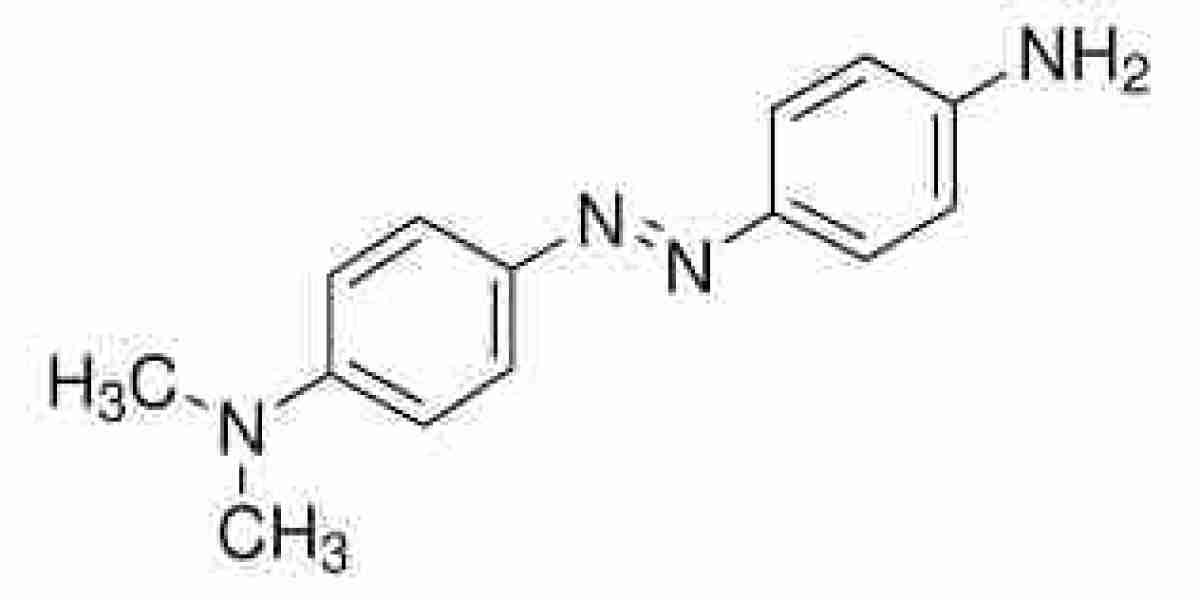

DMPA has emerged as a key ingredient in the formulation of waterborne polyurethane dispersions (PUDs), which are essential for creating coatings with excellent adhesion, chemical resistance, and flexibility. Its ionic functionality enables emulsification of polymers in water without the need for solvents, making it vital for industries undergoing green transitions.

Capital Investment Flows into Waterborne Coating Technologies

Major coatings and specialty chemical manufacturers are increasing capital expenditure toward expanding waterborne product lines. Multinational corporations are retooling facilities, upgrading equipment, and developing DMPA-based dispersions to meet the growing demand from sectors like automotive refinishing, wood coatings, and textile finishing.

These investments are not limited to developed economies. Emerging markets in Asia-Pacific, particularly China, India, and Southeast Asia, are rapidly expanding their waterborne coating infrastructure to comply with stricter environmental standards while catering to global clients. As a result, demand for DMPA as a dispersing monomer continues to rise in parallel with production capabilities.

Strategic Role of DMPA in Product Performance Enhancement

DMPA’s chemical structure enhances the performance of coatings without compromising their environmental profile. By providing carboxylic groups to polyurethane chains, it helps achieve better mechanical strength, abrasion resistance, and film clarity—features critical in high-performance industrial and decorative coatings.

These properties are driving its integration into advanced formulations that must meet both regulatory demands and end-user performance expectations. Whether used in coatings for automotive plastics or in corrosion-resistant formulations for infrastructure, DMPA’s versatility ensures it remains a valuable component in R&D strategies.

Innovation Driving Market Differentiation

With demand growing for low-VOC and sustainable products, coating companies are looking to differentiate through innovation. R&D efforts are increasingly centered around DMPA-derived polymers, such as self-crosslinking polyurethanes, UV-curable dispersions, and flexible resins for smart coatings.

Some manufacturers are blending DMPA with bio-based diols and polyester polyols to create partially renewable waterborne formulations, aligning with circular economy principles. Others are leveraging DMPA in coatings with advanced functionalities, including anti-graffiti, antimicrobial, and anti-corrosive properties—opening new high-value applications in urban infrastructure and electronics.

OEM and Consumer Demand Drive Investment Patterns

Original Equipment Manufacturers (OEMs), particularly in automotive, electronics, and appliances, are setting sustainability benchmarks for suppliers. Many require coatings that meet international environmental certifications, including LEED, Green Seal, and EU Ecolabel. DMPA-based PUDs fit these standards, making them increasingly sought after by formulation chemists.

Simultaneously, consumers are becoming more informed and vocal about the environmental impact of products they use. The coatings industry, responding to this shift, is channeling investments into DMPA-enabled technologies to ensure sustainability, performance, and compliance without trade-offs.

Supply Chain Readiness and Capacity Expansion

As demand for waterborne coatings rises, ensuring a stable DMPA supply chain becomes critical. Leading producers are scaling up production facilities and investing in backward integration to secure raw material sources. This not only protects supply continuity but also enables tighter quality control and cost management.

In addition, regional diversification of manufacturing is gaining importance. Producers are expanding capacity across North America, Europe, and Asia to reduce lead times and improve logistics responsiveness, especially for global clients that require just-in-time delivery.

Competitive Landscape and Strategic Collaborations

The competitive landscape within the DMPA market is evolving as companies enter into strategic collaborations with coating manufacturers to co-develop application-specific dispersions. These partnerships are helping accelerate go-to-market timelines, improve formulation performance, and foster innovation pipelines.

Mergers, acquisitions, and joint ventures in the specialty chemicals space are also playing a role. Larger conglomerates are acquiring smaller niche DMPA manufacturers to expand their portfolio of eco-compliant materials. This consolidation further concentrates technical expertise and facilitates greater investment into product customization.

Future Outlook: Investment-Fueled Growth Momentum

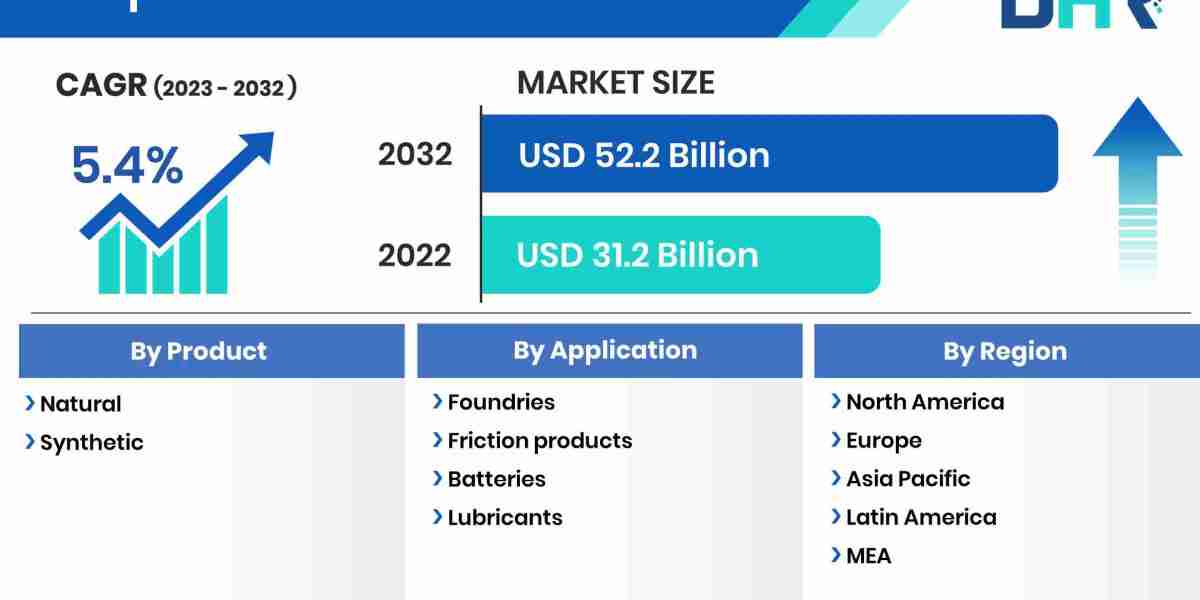

Looking forward, the DMPA market is expected to benefit from strong and sustained capital inflows targeting green coating technologies. Waterborne coatings are projected to outperform their solvent-based counterparts in both growth and profitability, driven by regulatory support and rising customer expectations.

As coating companies reengineer their product lines for sustainability, DMPA’s role will remain pivotal in enabling that transformation. From flexible R&D formulations to commercial production scalability, its unique chemistry makes it irreplaceable in the ongoing evolution of waterborne solutions.

Stakeholders that align investment strategies around DMPA and waterborne coatings are likely to gain a first-mover advantage in a regulatory environment that continues to favor clean, high-performance technologies.