The battery management system market inhibitors present significant hurdles that could slow down the otherwise rapid growth of this critical technology sector. Despite the strong momentum driven by increasing electrification, energy storage needs, and smart device adoption, several challenges limit the pace and scale of BMS deployment. Understanding these inhibitors is essential for stakeholders to develop effective solutions and strategies that can overcome barriers and unlock full market potential.

One of the foremost inhibitors is the high initial cost of BMS integration. Advanced battery management systems involve complex hardware and sophisticated software components, which increase production expenses. This cost factor is particularly influential in price-sensitive markets or lower-cost consumer products where manufacturers strive to balance affordability with performance. In electric vehicles and large-scale energy storage, the expense of a reliable, high-functionality BMS adds to the overall system cost, potentially delaying adoption or prompting the search for more economical alternatives.

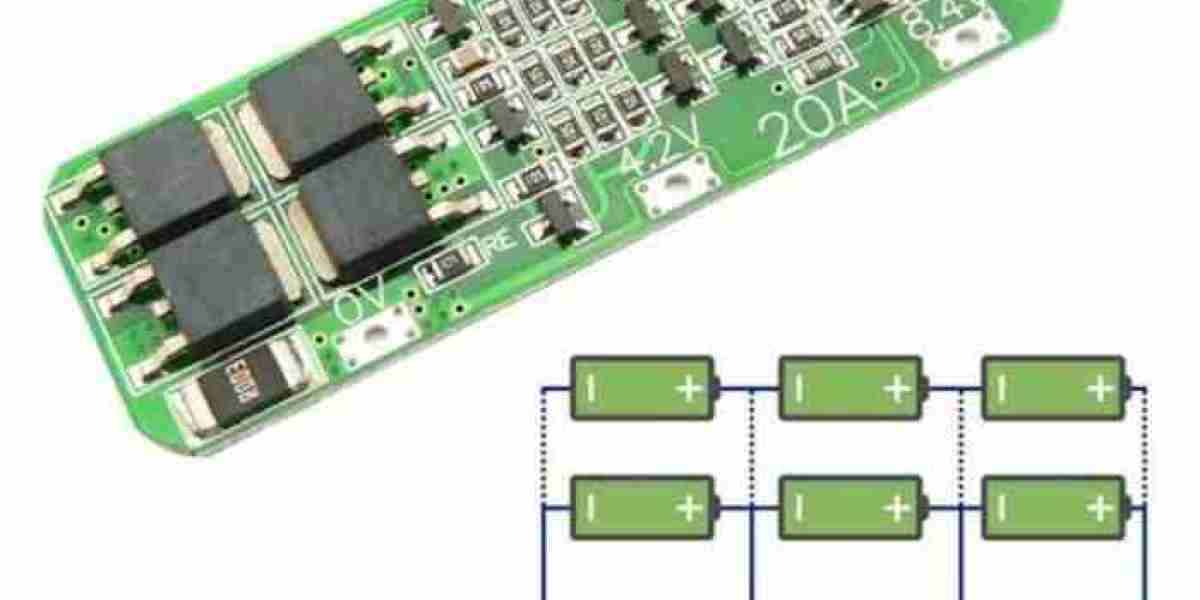

Technological complexity is another major market inhibitor. Battery management systems must perform numerous critical functions such as voltage regulation, temperature monitoring, state-of-charge estimation, and fault detection across multiple battery cells. Designing BMS that can accurately handle diverse battery chemistries, varying operating conditions, and integration with other vehicle or grid systems is a significant engineering challenge. This complexity often leads to longer development cycles, higher failure risks, and difficulties in standardization, which can impede scalability and mass production.

Safety concerns and liability issues remain a sensitive inhibitor for BMS adoption. Batteries, especially lithium-ion types, carry inherent risks like thermal runaway, fires, or explosions if improperly managed. While BMS are designed to mitigate these risks, any failure in the system can have serious consequences. Manufacturers and end-users may hesitate to adopt newer or unproven BMS technologies without extensive validation and certification. The fear of liability in case of malfunction also increases the caution exercised by stakeholders, which can slow market growth.

Regulatory and certification challenges pose significant hurdles for BMS providers. The battery market is governed by an array of regional, national, and international standards related to safety, performance, and environmental impact. Meeting these diverse regulations requires considerable time, resources, and expertise. Variations in standards across different geographies further complicate product development and market entry strategies. For smaller companies or new entrants, the regulatory burden can be a formidable barrier, limiting competition and innovation.

Lack of industry-wide standards and interoperability is a key inhibitor in the BMS market. Unlike other mature technology sectors, BMS lacks universally accepted protocols or interfaces, resulting in fragmented solutions tailored to specific battery types or applications. This fragmentation makes integration difficult, especially for companies aiming to develop modular or scalable battery systems. The absence of standardized communication protocols between batteries, BMS, and external devices slows adoption and increases costs related to customization and testing.

Rapidly evolving battery technologies also contribute to market inhibitors. As battery chemistries improve and new types such as solid-state batteries emerge, BMS must constantly adapt to new specifications and safety requirements. This evolution creates uncertainty for manufacturers who may hesitate to invest heavily in developing systems that might quickly become obsolete. The need for continuous upgrades and redesigns leads to increased costs and complexity, discouraging some market players.

Power consumption and energy efficiency constraints of some BMS designs present another limitation. Battery management systems themselves consume energy to operate, and inefficient BMS can reduce the overall energy efficiency of battery-powered systems. In applications like electric vehicles or portable electronics, even small losses can impact battery life and performance. Achieving the optimal balance between functionality and low power consumption remains a technical challenge and market inhibitor.

Market fragmentation and competitive pressure also affect the BMS landscape. The presence of many small and medium-sized players alongside large established corporations creates intense competition but also market fragmentation. This dynamic can lead to price wars, reduced profitability, and slow technology consolidation. For buyers, the large variety of offerings with varying quality levels creates confusion and hesitance in procurement decisions.

Supply chain constraints and component shortages have also emerged as inhibitors, particularly after recent global disruptions. The reliance on specialized semiconductor chips, sensors, and electronic components for BMS makes the market vulnerable to supply bottlenecks. Delays or cost increases in component sourcing can disrupt production schedules, inflate prices, and limit the ability of manufacturers to meet growing demand.

Customer awareness and education gaps further inhibit the widespread adoption of advanced BMS. Many end-users, especially in emerging markets or traditional industries, lack a clear understanding of the benefits and operational requirements of sophisticated battery management. This knowledge gap can result in resistance to upgrading from simpler or no BMS solutions, thereby slowing market penetration.

In conclusion, while the battery management system market shows strong promise fueled by electrification and energy transformation trends, it faces multiple inhibitors that challenge its growth. High costs, technological complexities, safety concerns, regulatory hurdles, and evolving battery chemistries are the main factors restraining rapid adoption. Addressing these inhibitors through innovation, standardization, strategic partnerships, and enhanced education will be crucial for unlocking the full potential of BMS technologies and supporting the global transition toward sustainable energy and mobility solutions.